24 June 2025

India's mining and construction equipment sector is currently approximately US$16 billion and is expected to reach US$45 billion by 2030. This exceptional growth is being driven by a surge in public and private investment, the "Make in India" initiative, and manufacturing policy with competitive support from global OEMs.

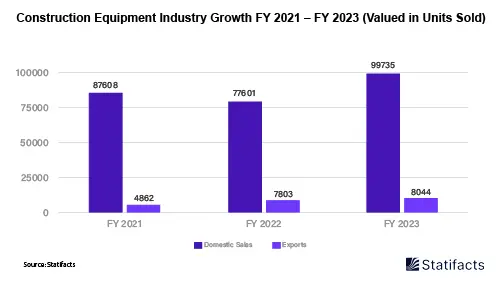

The graph indicates year on year growth in construction equipment (CE) sales, the chart shows an increase from 80,000 units in FY22 to over 100,000 in FY23, and afterwards divided sales by equipment types in earthmoving, road equipment, concrete, material handling, and material processing to view continuing pattern in the pandemic recovery and ongoing infrastructure rebound, with a 28% quarter-on-quarter increase in Q3 FY25 in other earthmoving, road equipment, concrete, material handling, and material processing.

What are the seasonal trends in India’s mining and construction sector?

ICEMA information indicates a 28% Sequential increase in sales for the second quarter of FY25, with customers selling 39,382 units total between October–December 2024, even while the FY25 overall growth was lower, indicating strong customer demand cycles.

Despite the FY25 growth dropping to just 3%, the slowest rate of growth seen in the last few years, prompted delays in project activity due to election periods and disruptions in contractor payments. However, the underlying demand remains strong.

There is increased emphasis on AI-enabled telematics, predictive fleet management systems, and software in CE companies to improve operational efficiency and increase uptime for customers.

The increase in sales in Q3 FY25 was further aided by pre-buying prior to the implementation of CEV V emission norms coming into effect in January `25, creating a market shift for customers to use cleaner and smarter machines.

Role of key players and artificial intelligence (AI) in shaping the market

Major original equipment manufacturers (OEMs) like Caterpillar India, who are led by V. Vivekanand (ICEMA President), along with JCB India, Volvo/Action, L&T, and Tata Hitachi, are driving innovation, localization, and export-led growth.

Vivekanand said: “As the Indian CE industry progresses towards Vision Plan 2035… the industry is exploring new technologies and developing a range of efficient and sustainable products.”

AI-enabled predictive analytics and data mesh systems are transforming CE and driving things like procurement, maintenance, safety, and deployment efficiency. India's AI industry can show ecosystems that can enable better cross-sector synergy to benefit technology adoption in CE.

India's construction equipment sector is on a steep growth trajectory, benefiting from rising sales from low levels, government backing, and technology integration, notably AI and emissions compliance. This sector may experience, like a number of industries in this election year, a potentially short-lived slowdown. However, underlying demand and momentum in innovation will likely ensure growth through to 2030 for India’s mining and construction sector.

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form

URL TO BE USED AS REFERENCE LINK:

Placeholder content for this accordion, which is intended to demonstrate the .accordion-flush class. This is the first item's

accordion body.

Placeholder content for this accordion, which is intended to demonstrate the .accordion-flush class. This is the second item's

accordion body. Let's imagine this being filled with some actual content.

Placeholder content for this accordion, which is intended to demonstrate the .accordion-flush class. This is the third

item's accordion body. Nothing more exciting happening here in terms of content, but just filling up the space to make it look, at least at

first glance, a bit more representative of how this would look in a real-world application.

Do you still any question?

Feel free to contact us anytime using our contact form or visit our FAQ page.

Your contact to the Infographics Newsroom