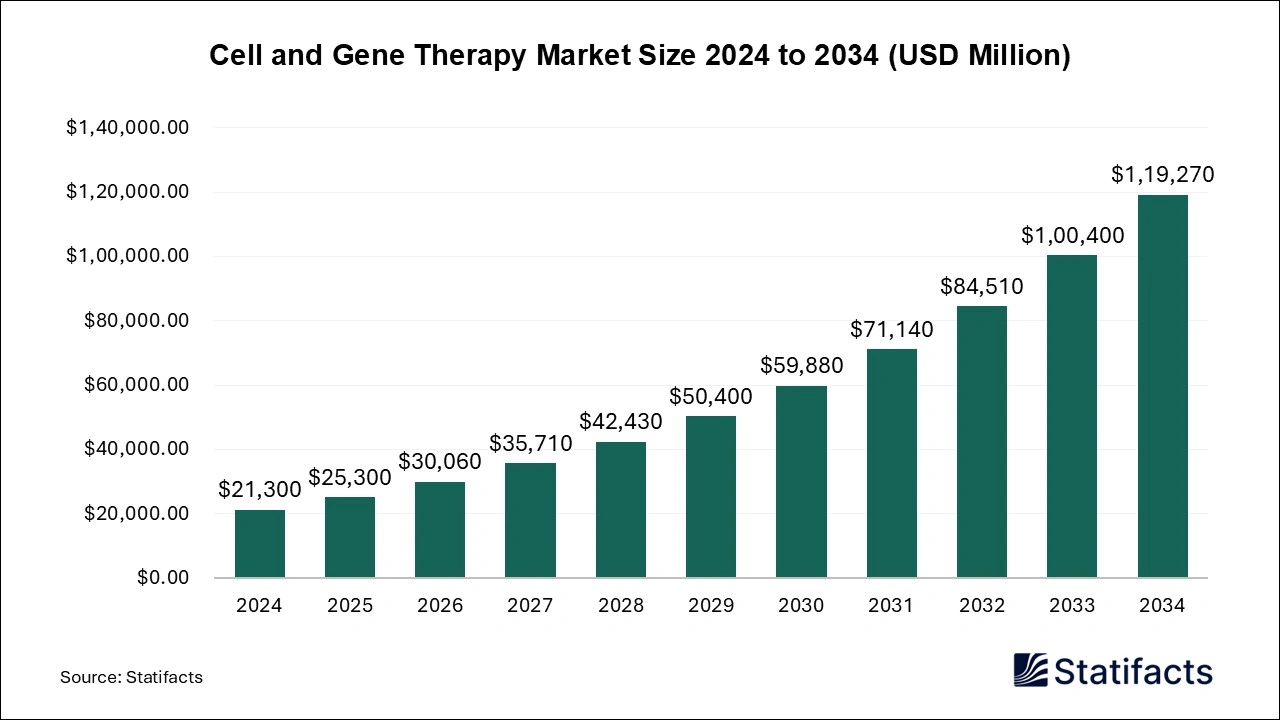

The global cell and gene therapy market size surpassed USD 21,300 million in 2024 and is predicted to reach around USD 1,19,270 million by 2034, registering a CAGR of 18.8% from 2025 to 2034.

Cell and Gene Therapy Market Report Highlights

- North America dominated the cell and gene therapy market in 2024.

- Asia-Pacific is observed to be the fastest growing in the market during the forecast period.

- By therapy type, the cell therapy segment dominated the market in 2024.

- By therapy type, the gene therapy segment is observed to be the fastest growing in the market during the forecast period.

- By therapeutic class, the infectious disease segment dominated the market in 2024.

- By delivery method, the in vivo segment dominated the market in 2024.

- By end user, the cancer care centers segment dominated the market in 2024.

Industry Valuation and Growth Rate Projection

| Industry Worth |

Details |

| Market Size in 2024 |

USD 21,300 Million |

| Market Size in 2025 |

USD 25,300 Million |

| Market Size in 2031 |

USD 71,140 Million |

| Market Size by 2034 |

USD 1,19,270 Million |

| Market Growth Rate from 2025 to 2034 |

CAGR of 18.8% |

| Base Year |

2024 |

| Forecast Period |

2025 to 2034 |

The cell and gene therapy market deals with the biotechnology of removal or switching the content of an individual’s genetic code to diagnose or cure a disorder. This is attained by direct injecting genetic material or by changing cells and re-enlisting those for the therapy. Developments in biotechnology have contributed to the acceptance of customized treatments for a broader span of demonstration. Stem cell treatments are now used to tackle cancer, genetic disorders, neurological disorders, and diverse chronic disorders. Furthermore, the supremacy of cell therapy involves targeted treatment, fast and efficient recovery, and decreased side effects. Cell therapies are broadly approved globally due to the accessibility of FDA-accepted products.

North America is the center for the sophisticated healthcare infrastructure and skilled medical providers which has led to the effective implementation and innovation in the cell and gene therapy market. Moreover, numerous collaborations between research institutions, academia, and pharmaceutical firms have encouraged proficiency-sharing and sped up the advancement of the latest therapies. This collective ecosystem promotes a vibrant and lively market structure. Thus, increasing knowledge among healthcare providers and patients about the advantages of gene and cell therapies has raised the approval and need for such treatments in the area. The potency for customized and curative therapies has collected remarkable awareness and notice.

Cell therapy aims to treat numerous disorders at the cellular extent like by replacing a definite cell population or by utilizing cells as transporters of therapeutic carriers, although gene therapy aims to control the path of numerous acquired and genetic diseases at the genetic proportion. Gene therapies also target to act towards inherited diseases along with acquired ones. It is expected that the high prevalence of cardiovascular disorders would speed up the need for the cell and gene therapy market.

A remarkable producing stain shows the item’s potency, safety, as well as quality as it needs high expenses and skills to assemble the various elements in a way that permits them to role. Discrepancies between groups in the producing of gene and cell therapies emerge particularly from the inherent living intricacies and susceptibility of the biological cells involved. Further, these therapies popularly apply to primary, genetically modified, or stem cells, which are organically seen in living variability. The change from laboratory-figure procedures to vast-scale making poses issues in handling compatible culture conditions, oxygen levels, and nutrient distribution, leading to contrast in cell behavior among groups.

AI has the potency to transform the cell and gene therapy market by allowing researchers to analyze huge amounts of information and generate new data about how cells function. A major advantage of utilizing artificial intelligence in cell therapy is its capability to assist in determining the best cells for a distinct patient. By understanding genomic data and determining disease-linked genetic variations, AI-based algorithms help in engineering tailored gene therapy methods and forecasting therapeutic results for patients, allowing for targeted therapy.

AI algorithms can detect potency gene targets and evaluate their therapeutic significance by determining vast-scale molecular and genomic datasets. This permits the determination of their aptness for gene therapy interventions. These discovery procedures assist in determining novel therapeutic targets, generating patient stratification methods, and demonstrating biomarkers to handle treatment effectiveness. This supports the advancement of the cell and gene therapy market.

Recent advancements in oncology have developed adoptive cell therapy for handling solid tumors, a region that has historically been stimulating for cell therapies. Thus, in-vivo cell and gene therapies have provided new rooms for disease diagnosis and treatment. In-vivo methods, which include delivering genetic changes directly into the individual’s body, have enhanced both treatment accessibility and efficacy.

The cell and gene therapy market has proceeded with growth, with the latest drug acceptance, innovative treatments targeted at enhancing individuals’ lives, and growing investments in the field. Cell and gene therapy is growing into newly discovered disease zones and utilizing more developed therapeutic methods. Thus, challenges remain, mainly in the regulatory landscape, which demands progress to fund not only acquisitions and mergers but also the acceptance procedures for these remarkable therapies.

Cell and Gene Therapy Market Share, By Region, 2024 (%)

| Regions |

Shares (%) |

| North America |

45% |

| Asia Pacific |

25% |

| Europe |

20% |

| LAMEA |

10% |

- North America - Dominates with 45% share, supported by strong R&D, regulatory approvals, and healthcare infrastructure.

- Asia Pacific - With 25% share, adoption is growing due to increasing clinical trials and biotechnology investments.

- Europe - At 20% share, steady growth driven by advanced medical facilities and regulatory support.

- LAMEA - Only 10% share, limited by infrastructure and slower adoption of advanced therapies.

Cell and Gene Therapy Market Share, By Therapy Type, 2024 (%)

| Segments |

Shares (%) |

| Cell Therapy |

55% |

| Gene Therapy |

45% |

- Cell Therapy - Leading with 55% share, driven by extensive clinical adoption and regenerative medicine applications.

- Gene Therapy- With 45% share, adoption is strong, fueled by growing R&D and increasing approvals for gene-based treatments.

Cell and Gene Therapy Market Share, By Therapeutic Class, 2024 (%)

| Segments |

Shares (%) |

| Cardiovascular Disease |

12% |

| Cancer |

25% |

| Genetic Disorder |

10% |

| Rare Diseases |

8% |

| Oncology |

15% |

| Hematology |

6% |

| Ophthalmology |

5% |

| Infectious Disease |

7% |

| Neurological Disorders |

9% |

| Others |

3% |

- Cardiovascular Disease- Holds 12% share, supported by targeted therapy development for heart-related conditions.

- Cancer - Leading with 25% share, driven by high demand for innovative oncology treatments.

- Genetic Disorder - With 10% share, adoption is moderate, focused on rare and inherited conditions.

- Rare Diseases - At 8% share, limited adoption due to smaller patient populations.

- Oncology - With 15% share, growth is strong from specialized cancer therapies and clinical trials.

- Hematology - Holds 6% share, focused on blood-related disorders and niche applications.

- Ophthalmology - At 5% share, adoption is low, limited to targeted eye disease treatments.

- Infectious Disease - With 7% share, niche adoption for emerging infectious disease therapies.

- Neurological Disorders - Holds 9% share, growing slowly with advancements in neuroregenerative medicine.

- Others - Only 3% share, covering miscellaneous niche therapeutic areas.

Cell and Gene Therapy Market Share, By Delivery Method, 2024 (%)

| Segments |

Shares (%) |

| In Vivo |

60% |

| Ex Vivo |

40% |

- In Vivo - Dominates with 60% share due to direct administration advantages and simplified protocols.

- Ex Vivo - With 40% share, adoption is significant but secondary due to complex cell processing requirements.

Cell and Gene Therapy Market Share, By End Users, 2024 (%)

| Segments |

Shares (%) |

| Hospitals |

50% |

| Cancer Care Centers |

35% |

| Others |

15% |

- Hospitals - Leading with 50% share, driven by widespread patient access and clinical infrastructure.

- Cancer Care Centers - With 35% share, specialized adoption is strong, focusing on oncology treatments.

- Others - At 15% share, adoption is limited to research centers and smaller clinics.

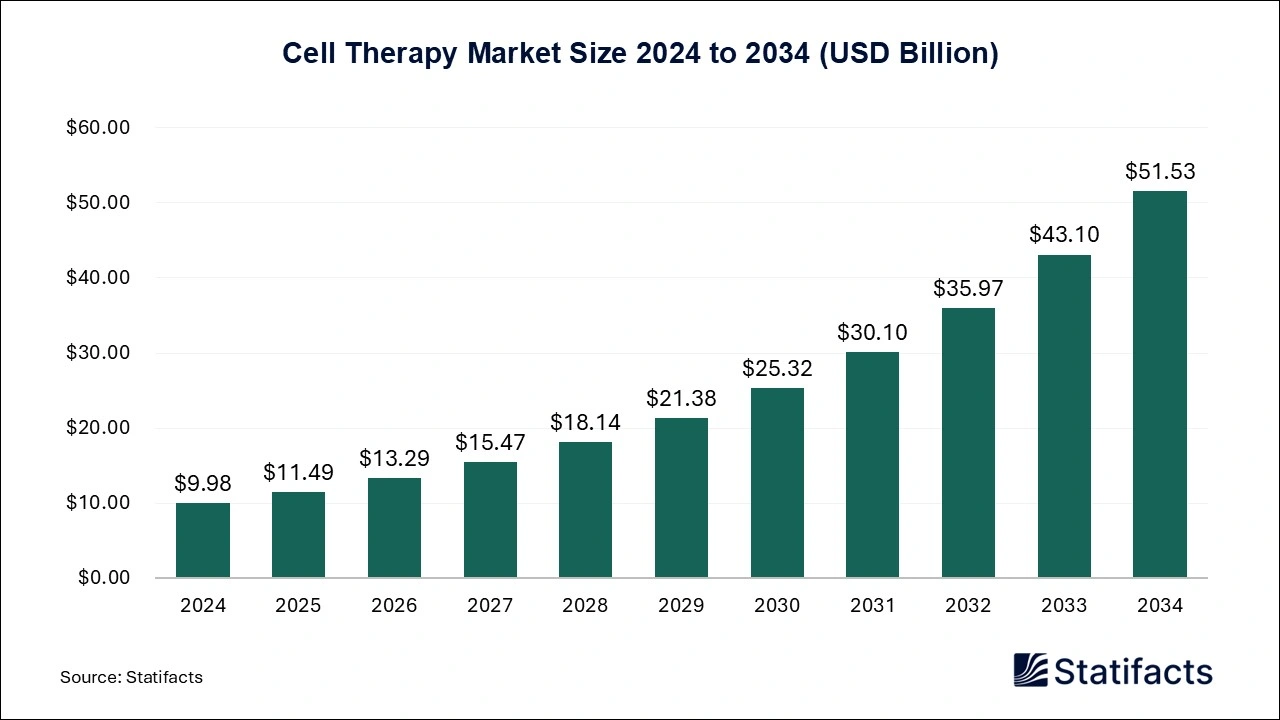

Cell Therapy Market Size 2025 to 2034 (USD Billion)

The global cell therapy market size was valued at USD 9.98 billion in 2024 and is projected to reach USD 51.53 billion by 2034, growing at a CAGR of 17.84%. Growth is driven by advances in stem cell research, personalized therapies, and innovative treatment approaches, with North America leading and APAC showing steady expansion.

Gene Therapy Market Size 2025 to 2034 (USD Billion)

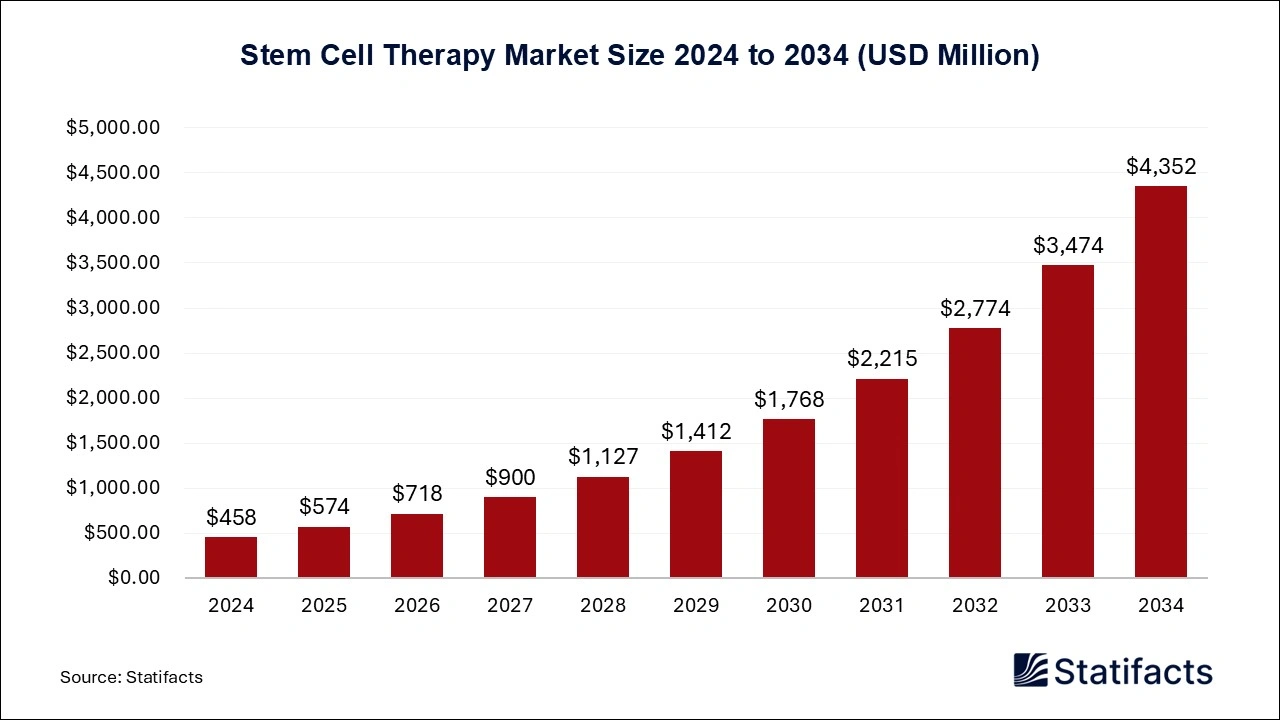

Stem Cell Therapy Market Size 2025 to 2034 (USD Billion)

The global stem cell therapy market size was valued at USD 16.04 billion in 2024 and is projected to reach USD 54.45 billion by 2034, growing at a CAGR of 13% between 2025 and 2034, driven by rising adoption in regenerative medicine and chronic disease treatments.