Last Updated: 02 Jul 2025

Source: Statifacts

By clicking “Accept All Cookies” you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

Privacy Policy

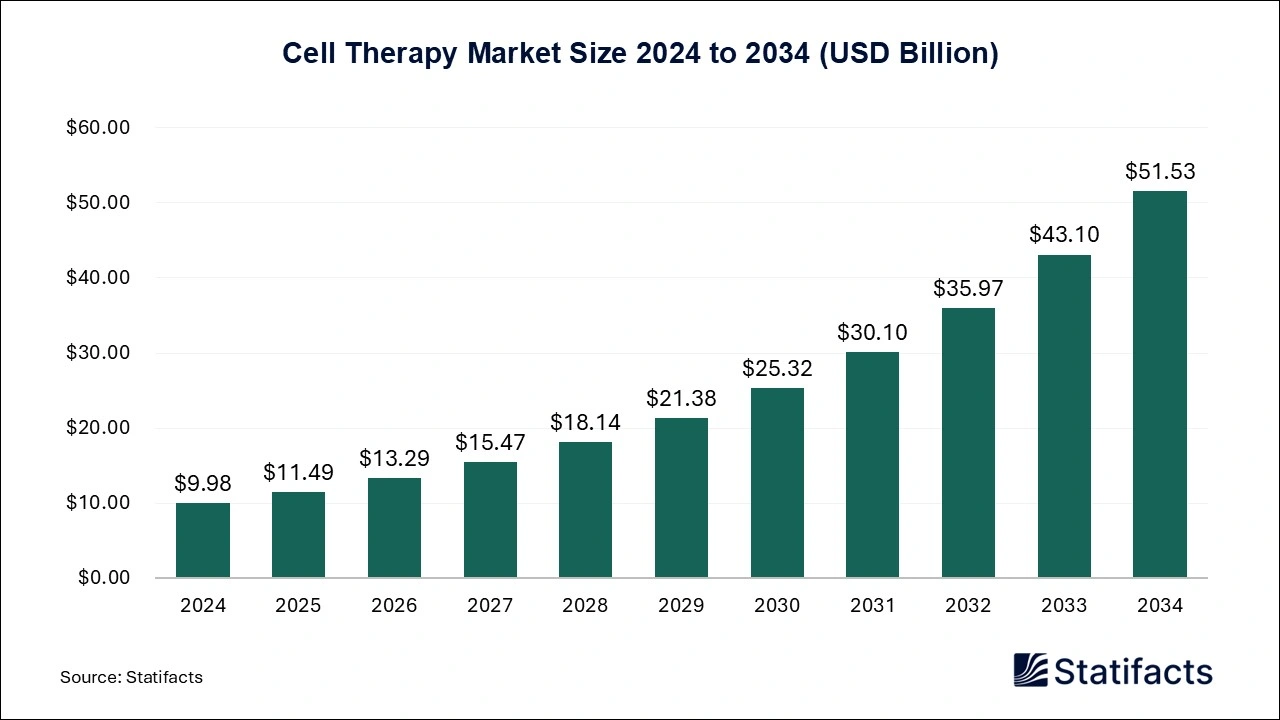

The global cell therapy market size was evaluated at USD 9.98 billion in 2024 and is expected to grow around USD 51.53 billion by 2034, registering a CAGR of 17.84% from 2025 to 2034. The market can be seen growing due to progressions in technologies like stem cells research, evolution in healthcare for formulation of new therapeutic approaches, and the potential of delivering personalized treatments customized for patients’ needs. The North America region took the lead in the cell therapy market. The APAC region is expected to grow steadily in the forecast period.

| Industry Worth | Details |

| Market Size in 2025 | USD 11.49 Billion |

| Market Size by 2034 | USD 51.53 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 17.84% |

The cell therapy market encompasses cell therapy, which includes the transmission of living cells into a patient using injections or surgical implantation to cure or avert any medical condition through replacing, repairing, or augmenting damaged or diseased cells and tissues. These cells can be obtained from the patient (autologous) or a donor (allogeneic). Some of their applications include neurological disorders, cancer, cardiovascular diseases, and orthopedic conditions.

The types of cell therapy include transfusion of blood, Hematopoietic Stem Cell Transplantation (HSCT), and gene-modified cell therapy. Advances in technologies like 3D cell culture and automation are the reason why cell therapy is in demand. The regulatory bodies are encouraging the approval processes for cell therapies for treating diseases like leukemia and lymphoma.

The cell therapy market has benefited from AI in a lot of ways. By studying immense datasets, AI can speed up the process of drug discovery and enhance treatment protocols. It has the ability to simplify treatment procedures and lessen expenses related to the same in cell therapy. AI can use its predictive abilities to see how the patient is responding and detect potential threats or adversities. It can also foresee the dosage needed by patients, thus helping doctors and surgeons to make decisions accordingly. Moreover, AI can optimize cell delivery, trace cell migration, and supervise treatment results. AI has a bright future in cell therapy as long as it can become even more efficient and modified in healing diseases.

The market is moving forward due to the improvements in stem cell research and regenerative medicine. This research is responsible for the creation of innovative cell-based therapies for various diseases. Technologies like CRISPR-Cas9, mesenchymal stem cell therapy, CAR T-cell therapy, and Tumor-Infiltrating Lymphocyte (TIL) Therapy are considered to be one of these innovative therapies.

The regulatory bodies look after what products need clinical trials to prove safety and efficacy, and authenticate licensing requirements for any product. Cell-based therapies are backed by regulatory policies and approvals. Governments across the world are acknowledging the capacity and are strengthening the development of these therapies.

The cell therapy market often deals with complicated manufacturing and supply chains. The process involves cell sourcing, isolation, modification, expansion, formulation, and rigorous testing at various stages. Since these many difficulties exist, the cell therapies, particularly the autologous ones, pose a challenge when sustaining sterile conditions, identity, and temperature control throughout the supply chain, beginning from production to clinical sites.

The other big challenge faced by the market is carrying the weight of questions relating to the safety and efficiency of cell therapies. These concerns involve risks of immune rejection, tumor formation, adverse reactions, thromboembolism and fibrosis, patient heterogeneity, and cell viability and survival. The perils differ based on different cell types.

The cell therapy is being massively helped by gene editing technologies, which are used to adapt and modify immune cells like T-cells. This helps in improving their ability to seek out and destroy cancer cells. Gene editing can put forward probable cures for genetic disorders such as cystic fibrosis and muscular dystrophy. In addition, evolutions in gene editing tools like CRISPR-Cas9 are boosting the accuracy and competence of cell therapy development.

Talking about the innovative technologies helping treat rare diseases, Steinhart said, "Our mission is to provide patients with rare diseases access to urgently needed therapeutic innovation. This partnership with stem cell pioneer RHEACELL enables us to jointly bring new treatment options to patients living with chronic venous wounds or Epidermolysis bullosa, who currently have limited or no treatment options. Our teams are fully committed to making these groundbreaking treatments available to all patients affected."

The stem cell therapy segment is maintaining a paramount spot due to various causes. It has the capability of curing diseases or medical conditions that were previously stated to be untreatable. These cells can segregate into several cell types, enabling tissue and organ regeneration. An excessive amount of research is going on to formulate new methodologies. Also, there are prospects available for rendering personalized therapies based on the patient’s needs.

This therapy has also taken a front seat as the fastest growing segment of the cell therapy market. There is a surge in funding from both government and private companies for research and development. The clinical trials taking place increasingly use stem cells. The results show that many diseases can be treated due to these trials. The patients can access stem cell therapy as more clinics are ready to offer it, keeping therapies in demand.

The Immune cell therapy segment has made significant progress in the cell therapy market. Synthetic biology has enabled the structuring of immune cells. The therapies, specifically CAR T-cell therapy, have proven to be effective for treating diverse types of cancer. The future of cancer treatment thus looks promising. These cells, also known as living therapies, can expand and narrow down according to the body's requirements, which results in long-term remedial effects.

The global cell therapy market is experiencing significant growth, with North America maintaining its position as the dominant region while Europe emerges as the fastest-growing market. The APAC region is expected to grow in the coming years.

North America

The North American region stood in an authoritative position regarding cell therapy. The reasons behind this are advances in technologies, a rising number of FDA approvals, and prominent healthcare infrastructure. The companies are progressively using treatments to cure diseases sooner than earlier.

The experimental treatment, known as zimislecel and created by Vertex Pharmaceuticals of Boston, United States, is a single infusion of a stem cell-based treatment, which may have restored 10 out of 12 people to health. These 10 patients do not require insulin at all, and the others needed much less dosage.

Europe

The market in Europe can be seen growing as a consequence of several factors, including supportive regulatory authorities, planned usage of Contract Manufacturing Organizations (CMOs), and patients increasingly adopting cell therapy. The companies are investing in other companies within the region.

APAC

The cell therapy market of the APAC is expected to grow significantly in the coming years, owing to the government supporting the development of cell therapy, considerable investments made in the research and development, and the huge number of people residing in the region. Additionally, the companies are getting together to form areas for the development of cell therapies.

Both Cellares and Mitsui Fudosan have publicized their preparations for establishing an automated, smart cell therapy manufacturing facility in Kashiwa City, Chiba Prefecture, Japan, which will have commercial-scale manufacturing of cell therapies, including CAR-T products, with operation and is expected to start in the year 2026.

The cell therapy market is highly competitive, with leading pharmaceutical companies such as Roche, Merck & Co., Bristol-Myers Squibb, Novartis, and Johnson & Johnson holding the highest market share. Emerging biotech firms also play a crucial role by fostering a dynamic and evolving competitive landscape.

The market is dominated by several pharmaceutical companies renowned for their significant contributions to cancer research and treatment. Based on recent data, the top three leading companies are:

Bristol-Myers Squibb is a biopharmaceutical company that delivers products in therapy areas like oncology, hematology, immunology, cardiovascular, and neuroscience. Some of its well-known products are Eliquis, Abecma, Abraxane, Breyanzi, Opdivo, Pomalyst, Reblozyl, Revlimid, Sprycel, and Yervoy. The countries in which this firm operates manufacturing units include the US, Switzerland, Puerto Rico, Ireland, and the Netherlands. This company is going to acquire shares of the firm 2seventy.

The yearly revenue of Bristol-Myers Squibb was positioned at $48,300,000 in 2024.

Novartis is a company operating in the healthcare sector. Its medicines and treatments reach several areas, including cardiovascular, renal and metabolic, immunology, ophthalmology, respiratory, global health, neuroscience, and oncology. Its products reach out to pharmacists, private health systems, government agencies, physicians, hospitals, insurance groups, and more. The manufacturing facilities of this firm are available in the US, Switzerland, Austria, Slovenia, China, France, and Italy. Pluvicto, which is a prostate cancer drug by this firm, has received approval from the FDA.

The annual revenue of Novartis was accounted to be $51,722,000 in 2024.

The products and services offered by Gilead Sciences involve treatments for HIV, hepatitis B and C, cancer, and inflammatory diseases. During the first trial of lenacapavir, a drug being tested by Gilead Sciences, over 2000 teenage girls and young women had been given the drug, and it was found after a year that none of them became infected with H.I.V.

The year-on-year revenue of Gilead Sciences stood at $28,754,000 in 2024

Published by Rohan Patil

Last Updated: 02 Jul 2025

Source: Statifacts

Last Updated: 02 Jul 2025

Source: Statifacts

| Subsegment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Stem Cell Therapy | 5,704.60 | 6,587.80 | 7,647.30 | 8,931.00 | 10,501.90 | 12,422.90 | 14,757.60 | 17,605.10 | 21,108.00 | 25,371.30 | 30,431.50 |

| Immune Cell Therapy | 3,260.90 | 3,742.60 | 4,317.70 | 5,011.50 | 5,856.70 | 6,885.30 | 8,128.90 | 9,637.60 | 11,483.90 | 13,718.30 | 16,352.90 |

| Others (Tissue Engineering Cells, Somatic Cells) | 1,018.20 | 1,160.40 | 1,329.20 | 1,531.80 | 1,777.10 | 2,073.90 | 2,430.40 | 2,859.90 | 3,382.00 | 4,009.10 | 4,742.00 |

Last Updated: 02 Jul 2025

Source: Statifacts

| Subsegment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Stem Cell Therapy | 5,704.60 | 6,587.80 | 7,647.30 | 8931 | 10,501.90 | 12,422.90 | 14,757.60 | 17,605.10 | 21108 | 25,371.30 | 30,431.50 |

| Immune Cell Therapy | 3,260.90 | 3,742.60 | 4,317.70 | 5,011.50 | 5,856.70 | 6,885.30 | 8,128.90 | 9,637.60 | 11,483.90 | 13,718.30 | 16,352.90 |

| Others (Tissue Engineering Cells, Somatic Cells) | 1,018.20 | 1,160.40 | 1,329.20 | 1,531.80 | 1,777.10 | 2,073.90 | 2,430.40 | 2,859.90 | 3382 | 4,009.10 | 4742 |

Cell therapy involves administering live cells into a patient to repair or replace damaged tissues, fight diseases, or restore normal function. It is commonly used in regenerative medicine and cancer treatment.

The main types include autologous (using the patient’s own cells) and allogeneic (using donor cells). CAR-T cell therapy and stem cell therapy are the most prominent applications.

The market is expanding due to rising chronic disease prevalence, technological advancements in cell processing, increased investment in regenerative medicine, and a growing number of FDA-approved cell therapies.

Major challenges include high development and manufacturing costs, complex logistics, scalability issues, and regulatory hurdles related to safety, quality, and long-term efficacy.

Key players include Novartis, Gilead Sciences (Kite Pharma), Bristol Myers Squibb, Bluebird Bio, and Fate Therapeutics, among others actively developing therapies for cancer and rare diseases.

To get full access to our Market Insights, you need a Professional Account or a Business Suite.

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Our customers work more efficiently and benefit from