23 May 2025

Indo-Pak tensions grow after the Pahalgam terror attack as a decades-long conflict between the two nations comes to a head, driving both countries to spend significant amounts on national military budgets and technological development. The aerospace and defence industries as crucial components of the national strategy. A systematic review of defence budgets, procurement policies, and technological capabilities demonstrates significant asymmetries that position India and Pakistan in terms of regional territorial influence and the global defence market.

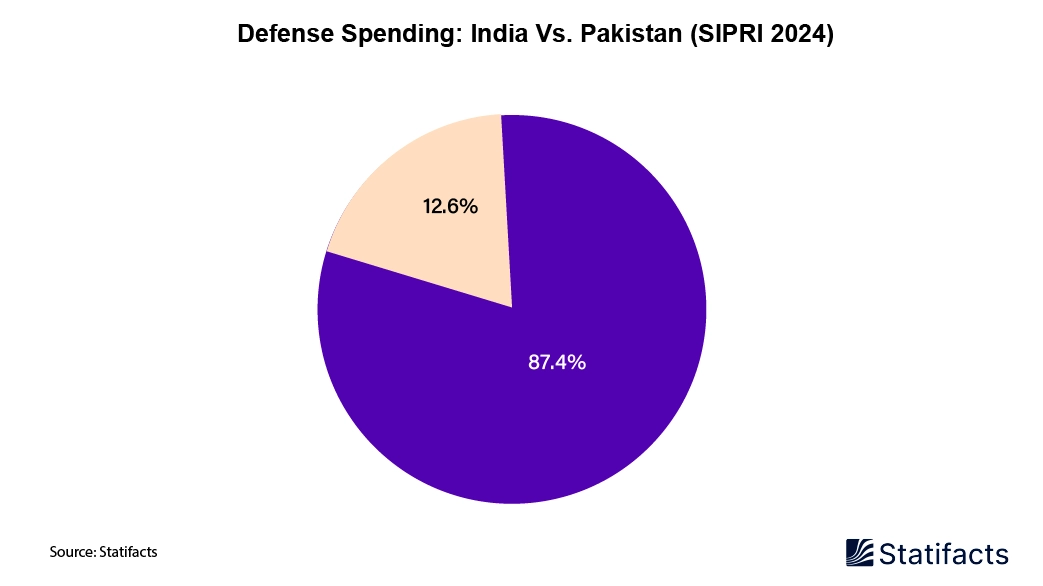

According to SIPRI 2024 data, India reported total defence spending of about US$ 86.1 billion, representing 2.3% of GDP, while Pakistan indicated US$ 10.2 billion defence spending, or 2.7% of GDP. While this creates an approximate 8:1 spending ratio and significant capability imbalance, it also results in divergent approaches to defence modernisation and aerospace developments.

India's defence budget proportions reflect the country's emergence as a significant military power with global aspirations. In FY 2024-25, approximately ₹6.21 trillion (US$74.6 billion) has been budgeted for defense, and a significant amount of these funds will be directed to indigenous defense production; the budget proportions indicate 68% revenue expenditure against only 32% capital acquisition, with the aerospace sector receiving approximately 35% of capital expenditure on fighters, some missiles, and space-based capabilities.

While Pakistan's defence budget is much smaller than India's in absolute terms, it consumes a larger share of GDP, highlighting the significant economic cost of maintaining parity in military capabilities. The 2024-25 budget of PKR 1.56 trillion ($11.2 billion) emphasises nuclear deterrence capabilities and the modernisation of conventional forces. Approximately 28% of the procurement budget was spent on the aerospace sector.

When comparing key aerospace and defence capabilities, there are apparent strategic disparities, such as:

Fighter Aircraft Fleets

Missile Capabilities

Defence Industrial Base

The implications for the aerospace industries of both countries extend beyond regional conflict. India's growing defence manufacturing capacity, supported by initiatives such as "Make in India" and the Defence Production Policy, is looking to realise $25 billion worth of defence exports by 2025. Indian aviation manufacturers such as Tata Advanced Systems, Mahindra Defence, and Larsen & Toubro are establishing important manufacturing capability within the aerospace industry.

Pakistan remains focused on maximising effectiveness by relying on low-cost solutions and forming strategic partnerships, particularly with China. The JF-17 Thunder program illustrates this ability, featuring successful technology transfer and collaborative production with over 130 JF-17 aircraft being produced locally, despite Pakistan having severely limited capability for independent research and development, resulting in limited long-term technological advancement.

New technology is transforming the local defence landscape; the two states are both investing heavily in unmanned aerial systems, electronic warfare, cyber-defence capabilities, and beyond. India intends its defence technology future to include artificial intelligence integration, advanced materials research, and perhaps quantum computing applications for defence systems.

Economic analysis indicates the opportunity cost of high defence spending. Pakistan's defence spending denotes budgetary compromises with development efforts, while India is spending primarily on dual-use technologies supporting broader economic development.

The implications of these Indo-Pak tensions for regional stability remain significant. The aerospace and defence build-up produces both deterrent effects and escalating risk. New missile capabilities and enhanced C4ISR capabilities (command/ control/ communications/ computer/ intelligence, surveillance, and reconnaissance) enhance early warning but reduce the timeframes for decision-making during crises.

Future developments also point to on-going asymmetric growth in defence capabilities. India has a larger economy and industrial base, allowing it to sustain relatively high levels of investment in advanced aerospace capabilities. China is turning to strategic partners and niche capabilities that it can rely on if it wants its deterrence to remain credible.

The global defence industry is watching Indo-Pak tensions closely as part of a larger market story. Arms suppliers in the United States, Russia, France, and China are fighting over contracts with both nations and the domestic defence industries in both nations are also emerging as competitors in international markets.

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form

URL TO BE USED AS REFERENCE LINK:

Placeholder content for this accordion, which is intended to demonstrate the .accordion-flush class. This is the first item's

accordion body.

Placeholder content for this accordion, which is intended to demonstrate the .accordion-flush class. This is the second item's

accordion body. Let's imagine this being filled with some actual content.

Placeholder content for this accordion, which is intended to demonstrate the .accordion-flush class. This is the third

item's accordion body. Nothing more exciting happening here in terms of content, but just filling up the space to make it look, at least at

first glance, a bit more representative of how this would look in a real-world application.

Do you still any question?

Feel free to contact us anytime using our contact form or visit our FAQ page.

Your contact to the Infographics Newsroom