04 July 2025

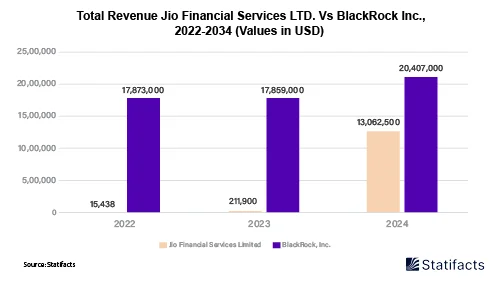

The entry of BlackRock, one of the world’s biggest asset managers, into the Indian market is turning more than a few heads. The American investment company’s big bet on the Indian financial sector is marked by the announcement of the Jio-BlackRock joint venture between the Indian telecom giant Jio on June 30th, 2025. Zeroda founder Nithin Kamath took to social media platform X, saying it was ‘great news’, and if the venture can help ‘expand the markets beyond the top 10 crore Indians,' it is more likely to see success.

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form

URL TO BE USED AS REFERENCE LINK:

Placeholder content for this accordion, which is intended to demonstrate the .accordion-flush class. This is the first item's

accordion body.

Placeholder content for this accordion, which is intended to demonstrate the .accordion-flush class. This is the second item's

accordion body. Let's imagine this being filled with some actual content.

Placeholder content for this accordion, which is intended to demonstrate the .accordion-flush class. This is the third

item's accordion body. Nothing more exciting happening here in terms of content, but just filling up the space to make it look, at least at

first glance, a bit more representative of how this would look in a real-world application.

Do you still any question?

Feel free to contact us anytime using our contact form or visit our FAQ page.

Your contact to the Infographics Newsroom