19 May 2025

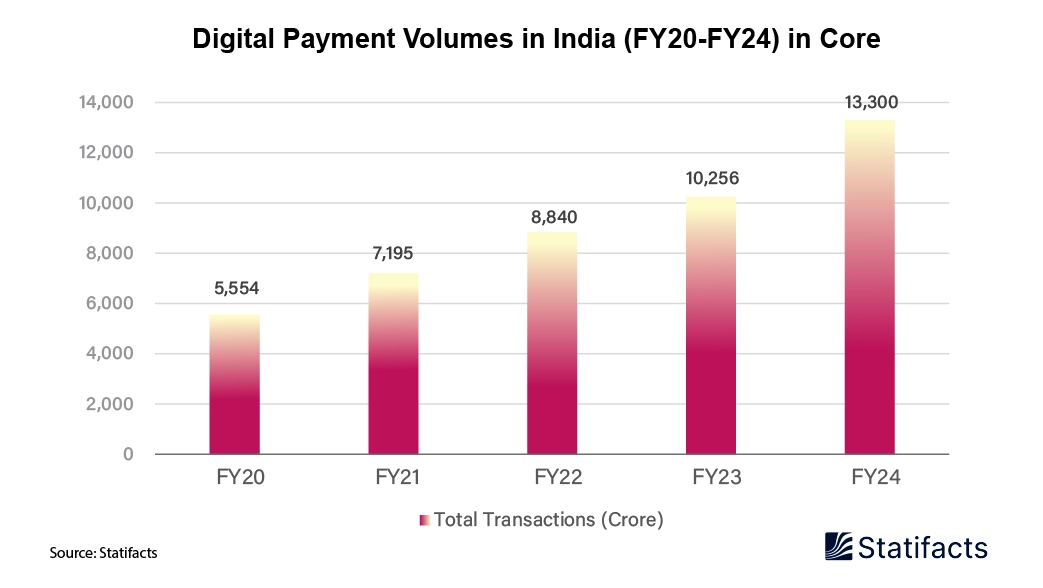

Indian digital payment volumes are indicative of its mushrooming online payment ecosystem with a historic milestone in FY24. During the year, the sub-continental country saw the processing of over 13,300 crore transactions, a massive 27% jump from FY23. The massive popularity of UPI, IMPS, and AePS transactions underscore India’s progress in digital financial inclusion. Online payments done through UPI accounted for nearly 76% of the total volume, reflecting rapid adoption across user segments.

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form

URL TO BE USED AS REFERENCE LINK:

Placeholder content for this accordion, which is intended to demonstrate the .accordion-flush class. This is the first item's

accordion body.

Placeholder content for this accordion, which is intended to demonstrate the .accordion-flush class. This is the second item's

accordion body. Let's imagine this being filled with some actual content.

Placeholder content for this accordion, which is intended to demonstrate the .accordion-flush class. This is the third

item's accordion body. Nothing more exciting happening here in terms of content, but just filling up the space to make it look, at least at

first glance, a bit more representative of how this would look in a real-world application.

Do you still any question?

Feel free to contact us anytime using our contact form or visit our FAQ page.

Your contact to the Infographics Newsroom