12 May 2025

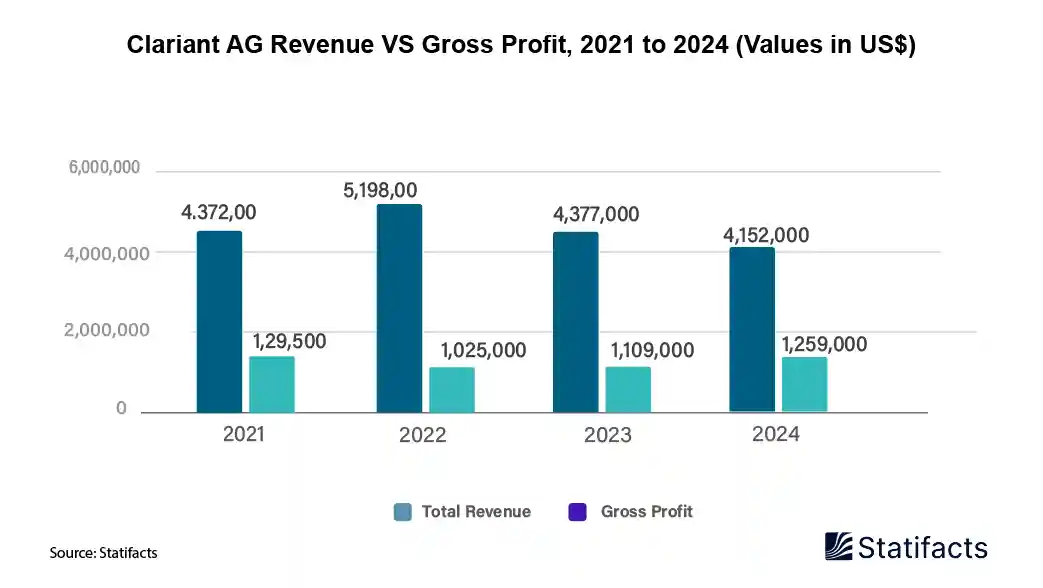

Swiss speciality chemicals group Clariant reported 12% year-on-year expansion in its catalyst business segment, well ahead of market expectations and underscoring the speeding-up transition to cleaner energy technologies among industrial sectors globally. The expansion occurs in the face of tough macroeconomic conditions facing wide sections of the chemical industry, which underscores the strategic merits of Clariant's repositioning towards sustainability-oriented solutions. The catalyst business, now accounting for some 28% of Clariant's group turnover, reported sales of CHF 452 million ($497 million) during the first quarter of 2025, its most recent set of financial reports.

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form

URL TO BE USED AS REFERENCE LINK:

Placeholder content for this accordion, which is intended to demonstrate the .accordion-flush class. This is the first item's

accordion body.

Placeholder content for this accordion, which is intended to demonstrate the .accordion-flush class. This is the second item's

accordion body. Let's imagine this being filled with some actual content.

Placeholder content for this accordion, which is intended to demonstrate the .accordion-flush class. This is the third

item's accordion body. Nothing more exciting happening here in terms of content, but just filling up the space to make it look, at least at

first glance, a bit more representative of how this would look in a real-world application.

Do you still any question?

Feel free to contact us anytime using our contact form or visit our FAQ page.

Your contact to the Infographics Newsroom