Last Updated: 31 Jul 2025

Source: Statifacts

By clicking “Accept All Cookies” you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

Privacy PolicyOncolytic Virotherapy Market (By Product: Monoclonal Antibodies; Immunomodulators; Oncolytic Viral Therapies and Cancer Vaccines; By Application: Lung Cancer, Breast Cancer, Colorectal Cancer, Melanoma, Prostate Cancer, Head & Neck Cancer, Ovarian Cancer, Pancreatic Cancer, Others; By Distribution ; By End Use ; By Region: North America, Europe, Asia Pacific, Latin America, Middle East & Africa) — Industry Size, Share, Growth, Trends 2025 to 2034

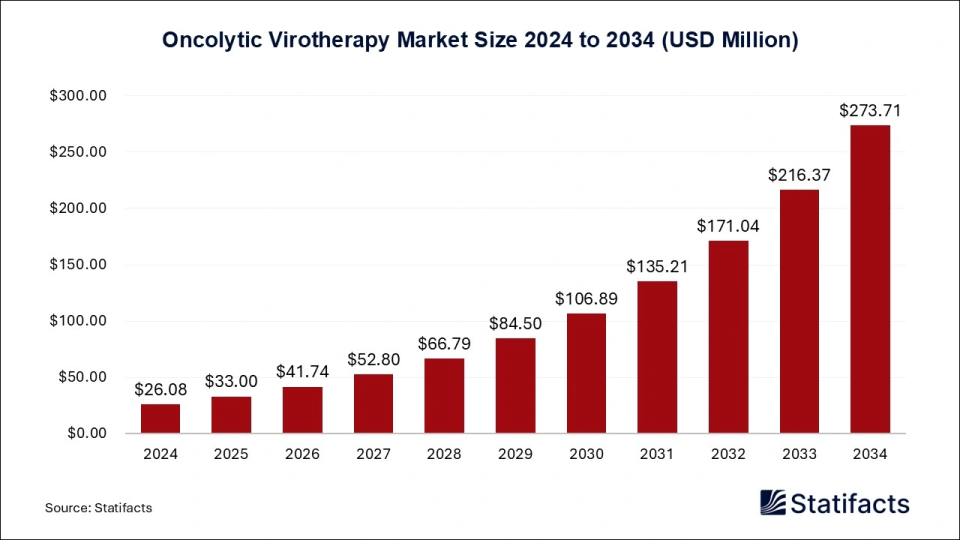

The global oncolytic virotherapy market size was evaluated at USD 26.08 million in 2024 and is expected to grow around USD 216.37 million by 2034, with a CAGR of 26.50% from 2025 to 2034. By their unique ability to selectively infect and lyse cancer cells and stimulate the immune system against cancer, oncolytic viruses represent novel anticancer therapies. Cancer treatments generally suffer from increased funding in the U.S. and Europe, which leads to R&D empowered by clinical activities. Genetic engineering-based technological advances promise higher efficacy and better safety. Awareness of the oncolytic viruses' modality to treat cancer, along with complementary therapeutic modalities and the regulatory framework, supports their acceptance.

| Reports Attributes | Statistics |

| Market Size in 2024 | USD 26.08 Million |

| Market Size in 2025 | USD 33 Million |

| Market Size in 2032 | USD 171.04 Million |

| Market Size by 2034 | USD 216.37 Million |

| CAGR 2025 to 2034 | 26.50% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

Global markets for oncolytic virotherapy are very fast-growing due to their new approach in treating cancer by directly targeting malignant cells and stimulating the body's immune system. The market is driven by the increasing number of cancer patients, the demand for gene-based therapies, and the increasing awareness of the benefits of virotherapy. Also, the advantages at the center of oncolytic virotherapy, namely positive clinical outcomes, a favorable regulatory environment, and research initiatives, raise market demand. Pharmaceutical companies are currently carrying out trials to combine oncolytic viruses with radiation therapy, immunotherapy, and chemotherapy to further enhance the therapeutic potential offered by oncolytic viruses, which in turn would expedite the incorporation of virotherapy into the mainstream.

The application of AI has been revolutionary in the market of oncolytic virotherapy (OV), as they are providing higher precision while reducing timelines for development and increasing diagnostic accuracy. AI platforms can analyze genetic and molecular data sets, design virus vectors with improved capacity for tumor targeting, and hasten the development of OV. AI systems serve to further treatments by analyzing patient-specific data with methods for prediction of individual responses, leading to predictions in early tumor detection and real-time monitoring; and they optimize clinical trial processes, including identifying candidate subjects and predicted outcomes.

The major market drivers in the oncolytic virotherapy market are rising cancer incidence, advancements in viral engineering, and the potential for targeted cancer cell destruction with minimal harm to healthy cells.

Clinical Successes and Regulatory Support:

The oncolytic virotherapy market is witnessing growth because of various clinical achievements and the shifting administrative nature of regulatory bodies. Upon successful trials demonstrating the safety and efficacy of oncolytic viruses to kill cancer cells, there arose great confidence from research workers, practitioners, and investors. This confidence has only risen since regulators have begun awarding early approvals, orphan drug designations, and fast-track approvals to approvals. The combination of precedent cases and this support has proven to be fertile soil for the swift innovation, funding, and commercialization of oncolytic virotherapy.

Growing Awareness and Investment:

The oncolytic virotherapy market is currently witnessing rapid growth due to increased awareness and investments. Information and educational initiatives are fueling awareness among patients and practitioners. Its specificity and minimal side effects have given the opportunity for the therapy to be integrated into cancer treatments. Funding from governments, research institutions, and private investors has given the impetus for research and development, which in turn fosters innovative clinical trials and takes scientific innovations to the stage of marketable therapies and growth in the market.

The growth of the oncolytic virotherapy market is restrained by factors such as high initial cost, complex manufacturing procedures, safety concerns, and regulatory hurdles.

Complex manufacturing and high costs

Manufacturing oncolytic virotherapy constitutes complex processes requiring advanced genetic engineering, specialized infrastructure, and stringent controls over quality. This was why their manufacturing costs were high, thus limiting accessibility and wide-scale use. The transition of technologies of research from laboratory to commercial production requires an enormous amount of investment with extreme infrastructure upgrades. It is through stringent controls, the skill of maximum personnel over virus stability and efficiency shall be maintained. Such intricacies usually contribute to treatment costs, pricing, and affordability to both the healthcare systems and patients, particularly in economically weaker sections.

Regulatory hurdles and safety concerns

Severe regulatory discrepancies, due to long and prohibitively priced clinical trials, are faced by oncolytic virotherapy, a treatment involving the use of genetically modified organisms. Regulatory bodies also impose stringent requirements relating to biosafety risk assessments, such as viral shedding, long-term consequences, and possible unwanted effects on the host or environment. These issues slow down the granting of approvals and consequent market entry and deter the investment, thus retarding the growth of the oncolytic virotherapy field of which they are necessary for public safety.

The opportunities in the oncolytic virotherapy market are associated with the latest technology, advancements in techniques, and increasing research and development.

Advancements in research and development

The oncolytic virotherapy market offers many opportunities, mainly for research and development. Researchers are working on many viral platforms, e.g., reoviruses, parvoviruses, and vaccinia viruses-to increase tumor selectivity and immune stimulation. Thus, time therapies might be soft-edited by gene-editing technologies such as CRISPR to be treated alongside tumor characteristics. Also, synergies between oncolytic virotherapy and chemotherapy, radiotherapy, immunotherapies such as checkpoint inhibition, and CAR T-cell therapies are being made. In addition to concerns in targeted delivery methods, new-generation delivery systems like intravenous delivery and cell-based carriers are under development to improve tumor targeting and decrease systemic toxicities.

“We’ve been making good progress in ovarian cancer, and this financing will support the rollout of our Phase II clinical trials. We’re excited to have already opened the first site in the US and are looking forward to dosing our first patients soon and opening at least five more sites this year.”

“MVR-T3011 represents a novel drug design and has the potential to address an unmet need in NMIBC. Integration of PD-1 Ab and IL-12 genes into the genome of this novel oncolytic immunotherapy can augment immune responses in the tumor microenvironment and prolong the early-phase antitumor efficacy.”

The genetically engineered oncolytic viruses are dominating the oncolytic virotherapy market because of their higher efficacy on tumor cells and fewer side effects on healthy cells. They have capabilities of precision gene delivery, robust viral replication, and stimulation of immune responses, thereby making them excellent candidates for targeted therapies for various cancers. Several biotech companies and research organizations are developing next-generation oncolytic viruses, which will be used alongside other therapies. The dominance of genetically engineered viruses is further cemented by way of strategic licensing deals and partnerships, further positioning them on the innovation charts in cancer treatment.

The oncolytic wild-type viruses are the fastest-growing segment of the oncolytic virotherapy market since they possess intrinsic oncolytic abilities that allow them to infect and destroy tumor cells without any genetic modifications. This is because of their consideration for safe, efficacious therapies having less regulatory back-and-forth compared with the engineered viruses. Besides, clinical trials are also being launched to evaluate their therapeutic uses in several varieties of cancer; synergistically functioning with immunotherapy and classical treatment approaches creates an attractive proposition in itself.

On the basis of application, the market is segmented into solid tumors and melanoma. The solid tumor segment held the largest market share in 2024. Regularly encountered solid tumors, such as breast, lung, prostate, and colon cancers, therefore, are therefore major targets for oncolytic virotherapy, owing to the high occurrence of these cancers. The ability of an oncolytic virus to penetrate dense tumor environments and then locally activate immune responses has always drawn attention toward alternative treatments. The presence of a larger market share is also due to the need to have more effective, less invasive treatment for advanced solid tumors. The clinical trials support the assumption regarding the safety and efficacy of oncolytic viruses in applications against solid tumors.

Being the fastest-growing sector of oncolytic virotherapy, melanoma, due to its unique biology, can benefit from solutions offered by immunotherapeutic modes of treatment, like those with an oncolytic virus. These viruses can kill melanoma cells directly while at the same time setting up an immune response that acts to prevent relapse. Successes of clinical studies provide proof of the need and potential use of such an approach, especially those with intratumoral injections. The immunogenicity of melanoma thus further fuels the interest and investment in immune therapies. There is further reinforcement of this through studies combining oncolytic viruses with checkpoint inhibitors.

The hospital segment emerged as the dominant sector in 2024. The oncolytic virotherapy market essentially remains hospital-oriented because of its particular infrastructure, trained human resources, and medical facilities. Hospitals are the first institutions for the diagnosis and treatment of cancer, and these institutions dispense complex biologics like oncolytic viruses. This dominance was enhanced through hospital-based oncology centers and larger health infrastructure. They remain the primary stakeholders in the development and sale of new cancer therapies because the hospital is involved with academic research institutions and pharmaceutical companies in the clinical trials for these new therapies. As the demand for precision medicine grows, hospitals shall remain stakeholders in the ecosystem of oncolytic virotherapy.

Cancer research institutes constitute the fastest-growing end-use segment in the oncolytic virotherapy market, and as such, they drive innovation and clinical trials. Their specialty being oncology allows rapid exploration of novel platforms for viruses and the advent of individualized treatment procedures. The institutes receive funding through bodies formed by the government, non-profit organizations, or private investors, thus allowing high-risk yet high-reward studies to be pursued. These next-generation virotherapies will be further developed in tandem with research centers and biotech companies, with this being a key step in facilitating the evolution of oncolytic virotherapy.

North America dominated oncolytic virotherapy in the markets owing to advanced healthcare infrastructure, high incidence of cancer, manifold, and a forceful R&D ecosystem. The US offers a ground for the leading biotechnology companies, academic institutions, and cancer research centers to ply their trade. Such a regulation-friendly climate, healthcare expenditures, and awareness are sufficient for market penetration. Partnerships between US companies and research bodies allow for further development and commercialization of treatments. Thus, in virotherapy, North America, by virtue of such a positive climate, will remain front-running both in innovation and in commercialization.

Oncolytic virotherapy is the fastest-growing marketplace in the Asia Pacific, due to increasing cancer incidences, healthcare infrastructure development, and biotechnology investments.

Governments in countries such as China, Japan, and South Korea have recognized the need to improve cancer treatment via grants and clinical research funding in conjunction with international biotechnology partnerships. The presence of large patient populations, coupled with knowledge of novel therapies, drives the adoption of the regional market. With new, clearer regulations and growing international collaborations, the Asia Pacific can have a sizeable impact on the global market growth.

The market is moderately fragmented with local players like Transgene SA, Pfizer Inc., Biotherapeutics Ltd., Transgene SA, Pfizer Inc., Lokon Pharma AB, Takara Bio Inc., Amgen Inc., TILT Oncorus, Inc., etc., wishing to take the time to edge their presence through investments, partnerships, acquisitions, and mergers. They also invest in product development and competitive pricing. These strategies will promote market growth and lucrative opportunities for market players

Full-year 2024 revenues were $63.6 billion, representing 7% year-over-year operational growth, while fourth-quarter revenues were $17.8 billion, reflecting 21% year-over-year operational growth.

In 2024, total revenues grew 19% to a record $33.4 billion.

In 2024, Transgene SA reported €6.4 million in operating revenue, a decrease from €7.9 million in 2023, primarily due to the discontinuation of the AstraZeneca collaboration in 2023.

| Regions | Shares (%) |

| North America | 42% |

| Asia Pacific | 28% |

| Europe | 22% |

| LAMEA | 8% |

| Segments | Shares (%) |

| Monoclonal Antibodies | 45% |

| Immunomodulators | 30% |

| Oncolytic Viral Therapies & Cancer Vaccines | 25% |

| Segments | Shares (%) |

| Lung Cancer | 18% |

| Breast Cancer | 16% |

| Colorectal Cancer | 14% |

| Melanoma | 10% |

| Prostate Cancer | 9% |

| Head and Neck Cancer | 8% |

| Ovarian Cancer | 7% |

| Pancreatic Cancer | 5% |

| Others | 13% |

| Segments | Shares (%) |

| Hospital Pharmacy | 70% |

| Retail Pharmacy | 20% |

| Online Pharmacy | 10% |

| Segments | Shares (%) |

| Hospitals & Clinics | 78% |

| Cancer Research Centers | 15% |

| Others | 7% |

Published by Rohan Patil

| Product | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Monoclonal Antibodies | 11.74 | 14.40 | 17.67 | 21.70 | 26.66 | 32.79 | 40.40 | 49.79 | 61.33 | 75.40 | 92.46 |

| Immunomodulators | 7.82 | 9.60 | 11.78 | 14.47 | 17.77 | 21.86 | 26.93 | 33.20 | 40.88 | 50.27 | 61.64 |

| Oncolytic Viral Therapies & Cancer Vaccines | 6.52 | 8 | 9.82 | 12.06 | 14.81 | 18.22 | 22.44 | 27.66 | 34.07 | 41.89 | 51.37 |

| Application | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Lung | 4.69 | 5.76 | 7.07 | 8.68 | 10.66 | 13.12 | 16.16 | 19.92 | 24.53 | 30.16 | 37 |

| Breast | 4.17 | 5.12 | 6.28 | 7.71 | 9.48 | 11.66 | 14.36 | 17.70 | 21.81 | 26.81 | 32.87 |

| Colorectal | 3.65 | 4.48 | 5.50 | 6.75 | 8.29 | 10.20 | 12.57 | 15.23 | 18.76 | 23.46 | 28.77 |

| Melanoma | 2.61 | 3.20 | 3.93 | 4.82 | 5.92 | 7.29 | 8.98 | 10.96 | 13.63 | 17.01 | 20.55 |

| Prostate | 2.35 | 2.88 | 3.53 | 4.34 | 5.33 | 6.56 | 8.08 | 9.96 | 12.27 | 15.08 | 18.49 |

| Head & Neck | 2.09 | 2.56 | 3.14 | 3.86 | 4.74 | 5.83 | 7.18 | 8.85 | 10.90 | 13.40 | 16.44 |

| Ovarian | 1.83 | 2.24 | 2.75 | 3.38 | 4.15 | 5.10 | 6.28 | 7.75 | 9.54 | 11.78 | 14.38 |

| Pancreatic | 1.30 | 1.60 | 1.96 | 2.41 | 2.96 | 3.64 | 4.49 | 5.53 | 6.81 | 8.38 | 10.27 |

| Others | 3.39 | 4.16 | 5.10 | 6.27 | 7.70 | 9.47 | 11.67 | 14.39 | 17.72 | 21.78 | 26.71 |

| Region | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| North America | 10.96 | 13.44 | 16.49 | 20.25 | 24.88 | 30.61 | 37.70 | 46.47 | 57.23 | 70.37 | 86.30 |

| Asia Pacific | 7.30 | 8.96 | 11 | 13.50 | 16.59 | 20.40 | 25.14 | 30.98 | 38.16 | 46.91 | 57.53 |

| Europe | 5.74 | 7.04 | 8.64 | 10.61 | 13.03 | 16.03 | 19.75 | 24.34 | 29.98 | 36.86 | 45.20 |

| LAMEA | 2.09 | 2.56 | 3.14 | 3.86 | 4.74 | 5.83 | 7.18 | 8.85 | 10.90 | 13.40 | 16.44 |

Last Updated: 31 Jul 2025

Source: Statifacts

| Subsegment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Monoclonal Antibodies | 11.74 | 14.40 | 17.67 | 21.70 | 26.66 | 32.79 | 40.40 | 49.79 | 61.33 | 75.40 | 92.46 |

| Immunomodulators | 7.82 | 9.60 | 11.78 | 14.47 | 17.77 | 21.86 | 26.93 | 33.20 | 40.88 | 50.27 | 61.64 |

| Oncolytic Viral Therapies & Cancer Vaccines | 6.52 | 8 | 9.82 | 12.06 | 14.81 | 18.22 | 22.44 | 27.66 | 34.07 | 41.89 | 51.37 |

| Subsegment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Lung | 4.69 | 5.76 | 7.07 | 8.68 | 10.66 | 13.12 | 16.16 | 19.92 | 24.53 | 30.16 | 37 |

| Breast | 4.17 | 5.12 | 6.28 | 7.71 | 9.48 | 11.66 | 14.36 | 17.70 | 21.81 | 26.81 | 32.87 |

| Colorectal | 3.65 | 4.48 | 5.50 | 6.75 | 8.29 | 10.20 | 12.57 | 15.23 | 18.76 | 23.46 | 28.77 |

| Melanoma | 2.61 | 3.20 | 3.93 | 4.82 | 5.92 | 7.29 | 8.98 | 10.96 | 13.63 | 17.01 | 20.55 |

| Prostate | 2.35 | 2.88 | 3.53 | 4.34 | 5.33 | 6.56 | 8.08 | 9.96 | 12.27 | 15.08 | 18.49 |

| Head & Neck | 2.09 | 2.56 | 3.14 | 3.86 | 4.74 | 5.83 | 7.18 | 8.85 | 10.90 | 13.40 | 16.44 |

| Ovarian | 1.83 | 2.24 | 2.75 | 3.38 | 4.15 | 5.10 | 6.28 | 7.75 | 9.54 | 11.78 | 14.38 |

| Pancreatic | 1.30 | 1.60 | 1.96 | 2.41 | 2.96 | 3.64 | 4.49 | 5.53 | 6.81 | 8.38 | 10.27 |

| Others | 3.39 | 4.16 | 5.10 | 6.27 | 7.70 | 9.47 | 11.67 | 14.39 | 17.72 | 21.78 | 26.71 |

| Subsegment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| North America | 10.96 | 13.44 | 16.49 | 20.25 | 24.88 | 30.61 | 37.70 | 46.47 | 57.23 | 70.37 | 86.30 |

| Asia Pacific | 7.30 | 8.96 | 11 | 13.50 | 16.59 | 20.40 | 25.14 | 30.98 | 38.16 | 46.91 | 57.53 |

| Europe | 5.74 | 7.04 | 8.64 | 10.61 | 13.03 | 16.03 | 19.75 | 24.34 | 29.98 | 36.86 | 45.20 |

| LAMEA | 2.09 | 2.56 | 3.14 | 3.86 | 4.74 | 5.83 | 7.18 | 8.85 | 10.90 | 13.40 | 16.44 |

Oncolytic virotherapy uses viruses, either engineered or naturally occurring, to selectively infect and destroy cancer cells while activating the patient’s immune system. It represents an emerging form of precision oncology with growing therapeutic promise.

Increased cancer prevalence, rising investment in R&D, and multiple clinical trials involving combination therapies are fueling expansion. Growth is also enabled by strategic biotech–pharma collaborations and broader physician awareness.

Engineered viruses, like adenovirus and herpes simplex strains, dominate usage due to targeted delivery capabilities. Solid tumors (e.g., breast, lung, melanoma) are the primary treatment focus, while hematological cancers are emerging targets.

North America leads adoption thanks to U.S. regulatory landmarks like the approval of T VEC and deep biotech infrastructure. Asia Pacific is the fastest-growing region, supported by expanding trials, healthcare investment, and favorable policy shifts.

High development and manufacturing costs, immune-related delivery limitations, and complex approval pathways pose challenges. Opportunities include personalized virus design, carrier cell delivery systems, and integration with AI-driven oncology tools.

To get full access to our Market Insights, you need a Professional Account or a Business Suite.

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Our customers work more efficiently and benefit from