By clicking “Accept All Cookies” you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

Privacy Policy

Medical Packaging HDPE Cards Market (By Type: Standard Type, Customized Type; By Application: Medical Devices, Pharmaceuticals, Electronics and Semiconductors, Others; By Region: North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) Industry Size, Share, Growth, Trends 2026 to 2034.

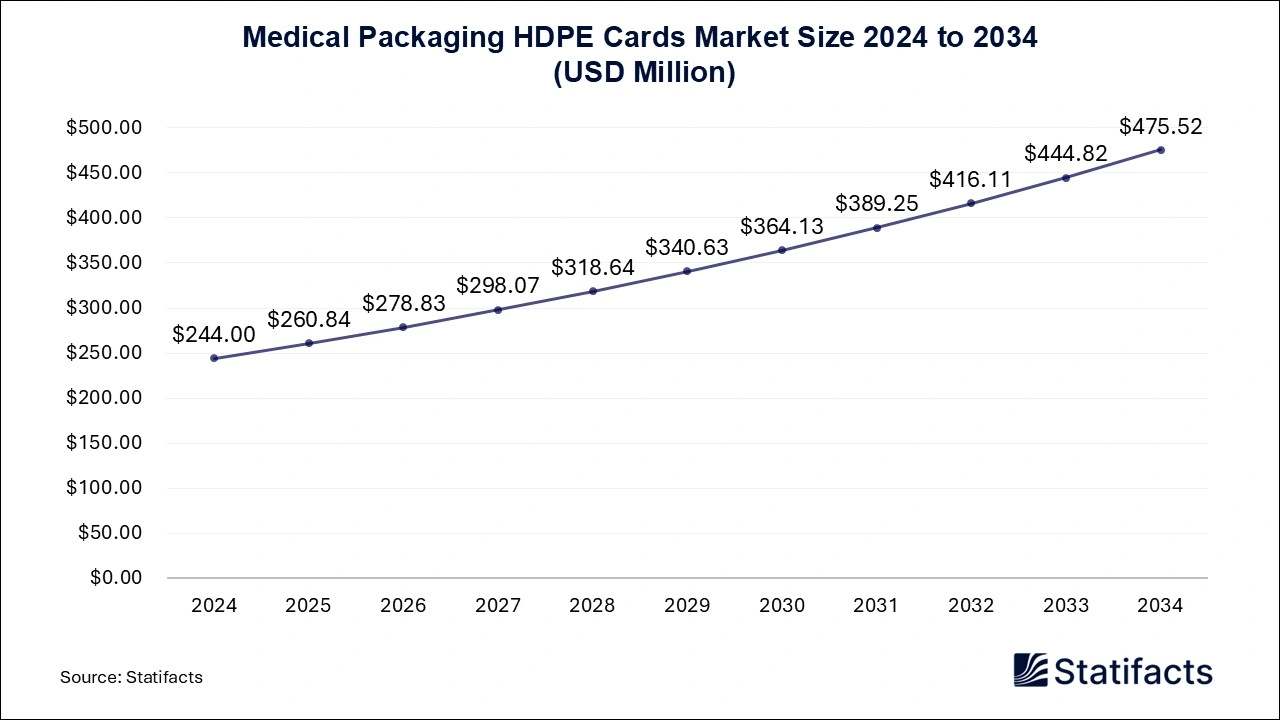

The global medical packaging HDPE cards market, valued at USD 260.84 million in 2025, is projected to reach USD 504.89 million by 2035, growing at a CAGR of 6.83% driven by increasing demand for durable, sterile, and sustainable healthcare packaging solutions.

| Reports Attributes | Statistics |

| Market Size in 2025 | USD 260.84 Million |

| Market Size in 2026 | USD 278.83 Million |

| Market Size in 2032 | USD 416.11 Million |

| Market Size by 2035 | USD 504.89 Million |

| CAGR 2026 to 2035 | 6.83% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

The market for medical packaging HDPE cards is growing due to the rising demand for secure device retention with reduced volume and weight, providing a cost-effective and recyclable substitute for thermoformed trays. An increased need for sterile, tamper-resistant, and eco-friendly packaging solutions in the healthcare sector additionally drives the market. Important prospects encompass the growth of medical device production in Asia and the ASEAN region, an increasing emphasis on eco-friendly packaging materials such as recycled HDPE, and the incorporation of intelligent technologies like RFID and AI, alongside progress in medical technology and more rigorous regulatory requirements, particularly in the Asia-Pacific and developing markets. Nonetheless, the market faces limitations, including fluctuations in raw material costs (such as HDPE resin), the need for certified cleanroom manufacturing, strict regulatory adherence, and competition from substitute materials.

Artificial intelligence (AI) is becoming increasingly vital in the medical packaging industry by enhancing quality assurance through immediate fault identification, increasing productivity through anticipatory maintenance, and supporting sustainable initiatives by maximizing material efficiency. AI helps to guarantee traceability and adherence to regulations by identifying inconsistencies in the supply chain. In the future, AI is anticipated to continue transforming packaging design, optimizing supply chains, and creating personalized medicine packaging.

| Regions | Shares (%) |

| North America | 36% |

| Asia Pacific | 27% |

| Europe | 25% |

| LAMEA | 12% |

| Segments | Shares (%) |

| Standard Type | 62% |

| Customized Type | 38% |

| Segments | Shares (%) |

| Medical Devices | 44% |

| Pharmaceuticals | 33% |

| Electronics and Semiconductors | 15% |

| Others | 8% |

Published by Vidyesh Swar

| Type | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2035 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Standard Type | 161.72 | 171.93 | 182.78 | 194.31 | 206.56 | 219.58 | 233.41 | 248.12 | 263.74 | 280.33 | 297.96 |

| Customized Type | 99.12 | 106.73 | 114.91 | 123.71 | 133.18 | 143.36 | 154.32 | 166.10 | 178.77 | 192.40 | 207.06 |

| Application | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2035 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Medical Devices | 114.77 | 122.05 | 129.79 | 138.02 | 146.77 | 156.06 | 165.95 | 176.46 | 187.62 | 199.49 | 212.11 |

| Pharmaceuticals | 86.08 | 92.24 | 98.83 | 105.90 | 113.47 | 121.58 | 130.28 | 139.59 | 149.57 | 160.26 | 171.71 |

| Electronics and Semiconductors | 39.13 | 41.99 | 45.07 | 48.37 | 51.91 | 55.71 | 59.79 | 64.16 | 68.85 | 73.89 | 79.29 |

| Others | 20.86 | 22.38 | 24 | 25.73 | 27.59 | 29.59 | 31.71 | 34.01 | 36.47 | 39.09 | 41.91 |

| Region | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2035 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| North America | 93.90 | 99.90 | 106.28 | 113.06 | 120.27 | 127.94 | 136.09 | 144.77 | 153.99 | 163.80 | 174.23 |

| Europe | 70.43 | 75.10 | 80.08 | 85.39 | 91.05 | 97.09 | 103.52 | 110.39 | 117.71 | 125.51 | 133.83 |

| Asia Pacific | 65.21 | 70.08 | 75.32 | 80.94 | 86.97 | 93.46 | 100.42 | 107.90 | 115.94 | 124.56 | 133.83 |

| LAMEA | 31.30 | 33.58 | 36.01 | 38.63 | 41.45 | 44.45 | 47.70 | 51.16 | 54.87 | 58.86 | 63.13 |

| Subsegment | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2035 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Standard Type | 161.72 | 171.93 | 182.78 | 194.31 | 206.56 | 219.58 | 233.41 | 248.12 | 263.74 | 280.33 | 297.96 |

| Customized Type | 99.12 | 106.73 | 114.91 | 123.71 | 133.18 | 143.36 | 154.32 | 166.10 | 178.77 | 192.40 | 207.06 |

| Subsegment | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2035 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Medical Devices | 114.77 | 122.05 | 129.79 | 138.02 | 146.77 | 156.06 | 165.95 | 176.46 | 187.62 | 199.49 | 212.11 |

| Pharmaceuticals | 86.08 | 92.24 | 98.83 | 105.90 | 113.47 | 121.58 | 130.28 | 139.59 | 149.57 | 160.26 | 171.71 |

| Electronics and Semiconductors | 39.13 | 41.99 | 45.07 | 48.37 | 51.91 | 55.71 | 59.79 | 64.16 | 68.85 | 73.89 | 79.29 |

| Others | 20.86 | 22.38 | 24 | 25.73 | 27.59 | 29.59 | 31.71 | 34.01 | 36.47 | 39.09 | 41.91 |

| Subsegment | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2035 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| North America | 93.90 | 99.90 | 106.28 | 113.06 | 120.27 | 127.94 | 136.09 | 144.77 | 153.99 | 163.80 | 174.23 |

| Europe | 70.43 | 75.10 | 80.08 | 85.39 | 91.05 | 97.09 | 103.52 | 110.39 | 117.71 | 125.51 | 133.83 |

| Asia Pacific | 65.21 | 70.08 | 75.32 | 80.94 | 86.97 | 93.46 | 100.42 | 107.90 | 115.94 | 124.56 | 133.83 |

| LAMEA | 31.30 | 33.58 | 36.01 | 38.63 | 41.45 | 44.45 | 47.70 | 51.16 | 54.87 | 58.86 | 63.13 |

To get full access to our Market Insights, you need a Professional Account or a Business Suite.

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Our customers work more efficiently and benefit from