By clicking “Accept All Cookies” you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

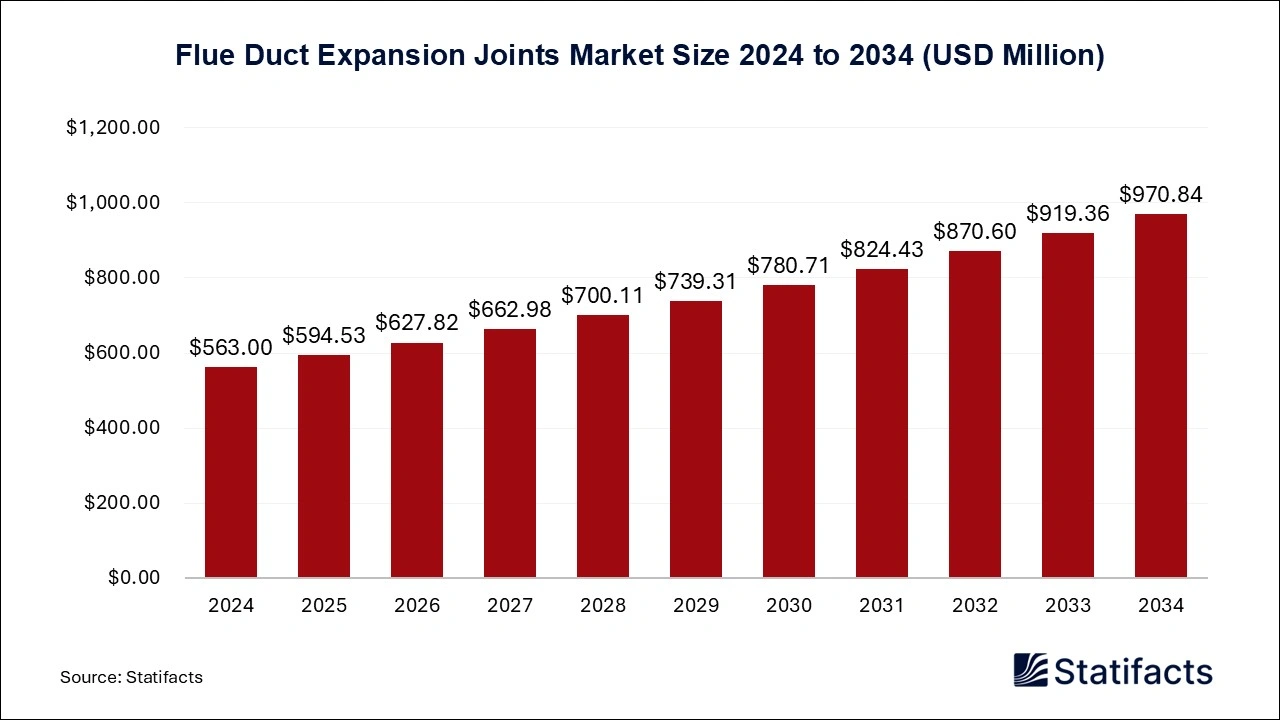

Privacy PolicyFlue Duct Expansion Joints Market (By Type: Belt Type, Flanged Type; By Application: Power Plants, Industrial, Others; By Region: North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) Industry Size, Share, Growth, Trends 2025 to 2034.

The global flue duct expansion joints market, valued at USD 563 million in 2024, is projected to reach USD 970.84 million by 2034, growing at a CAGR of 5.6% driven by increasing power plant installations and demand for efficient industrial exhaust systems.

| Reports Attributes | Statistics |

| Market Size in 2024 | USD 563 Million |

| Market Size in 2025 | USD 594.53 Million |

| Market Size in 2031 | USD 824.43 Million |

| Market Size by 2034 | USD 970.84 Million |

| CAGR 2025 to 2034 | 5.6% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

Flue duct expansion joints are intended to provide flexibility, absorb thermal expansion, reduce vibration and noise, and accommodate misalignment in industrial duct systems. The market for flue duct expansion joints is propelled by worldwide industrial growth, the need for power generation, and strict environmental regulations. Growth in industries such as cement, steel, oil, and gas, especially in the Asia-Pacific area, drives the need for parts that can endure severe thermal and mechanical pressures. Opportunities exist in utilizing high-performance materials such as engineered textiles and advanced metal alloys for improved durability, efficiency, and tailored solutions. The growing emphasis on renewable energy offers chances for specialized expansion joints in associated infrastructure ventures. Nonetheless, the market encounters challenges like fluctuating raw material prices, the threat of inferior substitute goods, and intricate production demands.

· Flexpert Bellows, a producer of metal and fabric expansion joints, has been showcasing its tailor-made products in 2025. Abirami Rubber Products has been promoting its specialized fabric and sleeve-style flue duct expansion joints during 2024 and 2025. V.V. Hitech introduced a stainless-steel flexible duct expansion joint in the year 2025.

Artificial intelligence (AI) is revolutionizing the sector by improving design, manufacturing, and upkeep. Generative design driven by AI assists engineers in optimizing joints for their performance, weight, and material efficiency by examining thousands of design options. In the manufacturing process, robotics powered by AI and computer vision technologies maintain uniform product quality by detecting defects and performing quality control evaluations in real-time. Moreover, AI enhances predictive maintenance by assessing sensor data from active flue ducts to foresee wear and possible failures, thus minimizing unplanned downtime and expensive repairs. AI is also utilized to enhance supply chain management through improved accuracy in demand forecasting and inventory planning.

| Regions | Shares (%) |

| North America | 22% |

| Asia Pacific | 44% |

| Europe | 23% |

| Latin America | 6% |

| Middle East & Africa | 5% |

| Segments | Shares (%) |

| Belt Type | 62% |

| Flanged Type | 38% |

| Segments | Shares (%) |

| Power Plants | 48% |

| Industrial | 42% |

| Others | 10% |

Published by Shubham Desale

| Type | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Belt Type | 349.06 | 367.42 | 386.74 | 407.07 | 428.47 | 450.98 | 474.67 | 499.61 | 525.84 | 553.45 | 582.50 |

| Flanged Type | 213.94 | 227.11 | 241.08 | 255.91 | 271.64 | 288.33 | 306.04 | 324.82 | 344.76 | 365.91 | 388.34 |

| Application | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Power Plants | 270.24 | 284.78 | 300.10 | 316.24 | 333.25 | 351.17 | 370.06 | 389.96 | 410.92 | 433.02 | 456.29 |

| Industrial | 236.46 | 250.89 | 266.20 | 282.43 | 299.65 | 317.90 | 337.27 | 357.80 | 379.58 | 402.68 | 427.17 |

| Others | 56.30 | 58.86 | 61.52 | 64.31 | 67.21 | 70.24 | 73.38 | 76.67 | 80.10 | 83.66 | 87.38 |

| Region | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| North America | 123.86 | 130.20 | 136.87 | 143.87 | 151.22 | 158.95 | 167.07 | 175.60 | 184.57 | 193.98 | 203.88 |

| Europe | 129.49 | 136.15 | 143.14 | 150.50 | 158.22 | 166.35 | 174.88 | 183.85 | 193.27 | 203.18 | 213.58 |

| Asia-Pacific | 247.72 | 262.78 | 278.75 | 295.69 | 313.65 | 332.69 | 352.88 | 374.29 | 396.99 | 421.06 | 446.59 |

| Latin America | 33.78 | 35.67 | 37.67 | 39.78 | 42.01 | 44.36 | 46.84 | 49.47 | 52.24 | 55.16 | 58.25 |

| Middle East and Africa | 28.15 | 29.73 | 31.39 | 33.14 | 35.01 | 36.96 | 39.04 | 41.22 | 43.53 | 45.98 | 48.54 |

| Subsegment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Belt Type | 349.06 | 367.42 | 386.74 | 407.07 | 428.47 | 450.98 | 474.67 | 499.61 | 525.84 | 553.45 | 582.50 |

| Flanged Type | 213.94 | 227.11 | 241.08 | 255.91 | 271.64 | 288.33 | 306.04 | 324.82 | 344.76 | 365.91 | 388.34 |

| Subsegment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Power Plants | 270.24 | 284.78 | 300.10 | 316.24 | 333.25 | 351.17 | 370.06 | 389.96 | 410.92 | 433.02 | 456.29 |

| Industrial | 236.46 | 250.89 | 266.20 | 282.43 | 299.65 | 317.90 | 337.27 | 357.80 | 379.58 | 402.68 | 427.17 |

| Others | 56.30 | 58.86 | 61.52 | 64.31 | 67.21 | 70.24 | 73.38 | 76.67 | 80.10 | 83.66 | 87.38 |

| Subsegment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| North America | 123.86 | 130.20 | 136.87 | 143.87 | 151.22 | 158.95 | 167.07 | 175.60 | 184.57 | 193.98 | 203.88 |

| Europe | 129.49 | 136.15 | 143.14 | 150.50 | 158.22 | 166.35 | 174.88 | 183.85 | 193.27 | 203.18 | 213.58 |

| Asia-Pacific | 247.72 | 262.78 | 278.75 | 295.69 | 313.65 | 332.69 | 352.88 | 374.29 | 396.99 | 421.06 | 446.59 |

| Latin America | 33.78 | 35.67 | 37.67 | 39.78 | 42.01 | 44.36 | 46.84 | 49.47 | 52.24 | 55.16 | 58.25 |

| Middle East and Africa | 28.15 | 29.73 | 31.39 | 33.14 | 35.01 | 36.96 | 39.04 | 41.22 | 43.53 | 45.98 | 48.54 |

To get full access to our Market Insights, you need a Professional Account or a Business Suite.

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Our customers work more efficiently and benefit from