By clicking “Accept All Cookies” you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

Privacy Policy

Europe Vehicle-to-Grid Technology Market (By Component Type: Smart Meters, Electric Vehicle Supply Equipment (EVSE), Software, Home Energy Management (HEM); By Application Type: Battery Electric Vehicles (BEVs), Fuel Cell Vehicles (FCVs), Plug-in Hybrid Electric Vehicles (PHEVs)) Industry Size, Share, Growth, Trends 2025 to 2034

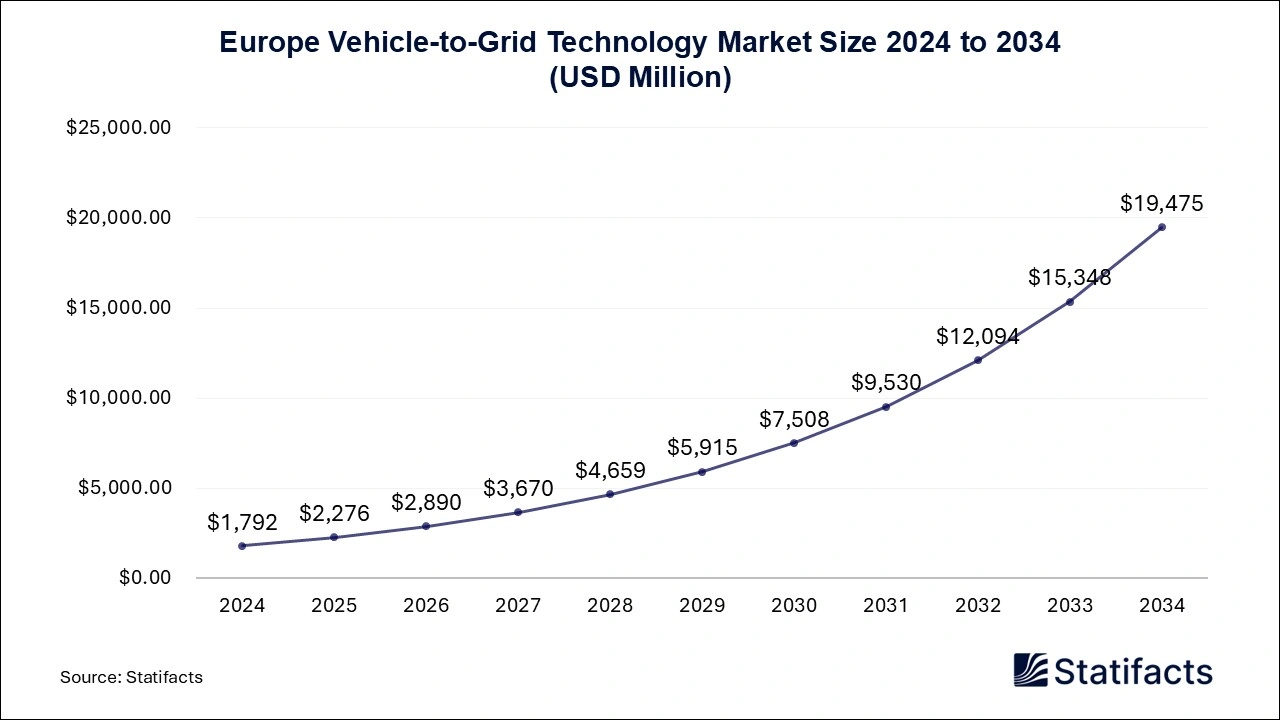

The europe vehicle-to-grid technology market surpassed USD 1,792 million in 2024 and is expected to reach USD 19,475 million by 2034, accelerating at a 26.94% CAGR driven by EV adoption and smart energy infrastructure advancements.

| Reports Attributes | Statistics |

| Market Size in 2024 | USD 1,792 Million |

| Market Size in 2025 | USD 2,276 Million |

| Market Size in 2031 | USD 9,530 Million |

| Market Size by 2034 | USD 19,475 Million |

| CAGR 2025 to 2034 | 26.94% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

The Europe vehicle-to-grid technology market is expanding at a lucrative pace due to the increasing renewable energy penetration across their countries. Renewable energy integration in the region has been a crucial factor, and V2G is essential to making the energy transition process more stable and reliable. European countries are known for their stringent sustainability regulations, which have increased the consumer base for electric vehicles. The IEA report states that about 1 in 5 new cars purchased in Europe were EVs in 2024. In 2024, 14 out of 27 EU states witnessed an increase in their EV sales share. The governments in these states are also investing in improving their EV charging infrastructure to help EV sales in the region.

The regulatory framework in the European region has been a challenging factor, as each country has its own rules, grid codes, and standards for EVs. The Europe Vehicle-to-grid technology market might face challenges towards V2G adoption due to these complications and lower consumer awareness. Additionally, bidirectional chargers still have lower penetration, which might slow the pace among residential owners.

Renewable energy is growing rapidly and has potential for V2G technology, where grid-balancing services will be in higher demand in the coming years to manage energy supply during peak hours. The European government is mainly focusing on electrifying its corporate fleets to make them reliable for V2G in their urban projects to efficiently manage these services. Technological advancements are helping countries participate in energy trading as a new business model, supported by commercial and personal EV owners. Moreover, automakers like Renault, Volkswagen, and Stellantis are partnering with grid operators, charger manufacturers, and others to expand their businesses.

European countries are increasingly adopting technologies such as artificial intelligence and machine learning to manage fluctuations in wind and solar energy and improve grid reliability. The rising integration of AI in smart charging and other technologies is making it more cost-effective and sustainable in the long run. Moreover, AI uses historical data with LSTM networks that forecast energy demand and renewable energy generation. The use of AI is also expected to improve in residential settings, where it is adopting driving patterns to maximize output with less waiting time.

The United Kingdom offers several opportunities in V2G pilot programs, where leading automakers are investing in managing energy needs. The UK government is investing in several V2G initiatives, including smart charging infrastructure and pilot programs funded by Amber, to improve the technology. For instance, in 2024, Octopus Energy also launched its first mass-market V2G tariff, which helps consumers earn money by providing V2G services with their EVs. These initiatives are expected to attract several businesses and commercial and residential users in the coming years, opening more energy storage options.

Germany plays an influential role in the growth of the European vehicle-to-grid technology market due to its large EV manufacturing base. The government is also investing in renewable energy projects, which are attracting investment for smart grids. Leading companies like E.ON and BMW have also introduced commercial V2G solutions for private customers in the country, allowing them to feed energy back into the grid.

BMW and E.ON have also launched the first commercial V2G solution for private customers in Germany, which allows electric vehicles to feed energy back into the grid for remuneration. These developments are supported by ongoing pilot projects and a growing market for V2G solutions in the country, driven by the increasing adoption of electric vehicles, notes

| Segments | Shares (%) |

| Smart Meters | 25% |

| Electric Vehicle Supply Equipment (EVSE) | 40% |

| Software | 20% |

| Home Energy Management (HEM) | 15% |

| Segments | Shares (%) |

| Battery Electric Vehicles (BEVs) | 65% |

| Fuel Cell Vehicles (FCVs) | 10% |

| Plug-in Hybrid Electric Vehicles (PHEVs) | 25% |

Published by Yogesh Kulkarni

| Component | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Smart Meters | 82.30 | 104.21 | 132.03 | 167.05 | 210.26 | 267.02 | 338.81 | 431.69 | 547.64 | 693.52 | 876.80 |

| Electric Vehicle Supply Equipment (EVSE) | 511.03 | 650.53 | 829.91 | 1,056.11 | 1,341.84 | 1,702.34 | 2,150.61 | 2,743.39 | 3,496.37 | 4,466.17 | 5,716.12 |

| Software | 688.98 | 871.84 | 1,106.62 | 1,413.43 | 1,793.64 | 2,295.35 | 2,926.30 | 3,713.73 | 4,715.65 | 5,986.91 | 7,590.48 |

| Home Energy Management (HEM) | 509.69 | 648.18 | 819.03 | 1,028.92 | 1,307.25 | 1,641.79 | 2,082.00 | 2,628.79 | 3,321.98 | 4,189.83 | 5,284.67 |

| Application | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Battery Electric Vehicles (BEVs) | 1,547.49 | 1,965.66 | 2,495.26 | 3,168.85 | 4,024.58 | 5,115.17 | 6,497.29 | 8,261.79 | 10,505.63 | 13,344.22 | 16,948.77 |

| Fuel Cell Vehicles (FCVs) | 144.16 | 183.12 | 232.17 | 293.71 | 372.05 | 466.64 | 591.28 | 741.09 | 925.41 | 1,171.33 | 1,475.68 |

| Plug-in Hybrid Electric Vehicles (PHEVs) | 100.35 | 125.98 | 160.15 | 202.95 | 256.36 | 324.69 | 409.15 | 514.73 | 650.60 | 820.89 | 1,043.62 |

| Subsegment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Smart Meters | 82.30 | 104.21 | 132.03 | 167.05 | 210.26 | 267.02 | 338.81 | 431.69 | 547.64 | 693.52 | 876.80 |

| Electric Vehicle Supply Equipment (EVSE) | 511.03 | 650.53 | 829.91 | 1,056.11 | 1,341.84 | 1,702.34 | 2,150.61 | 2,743.39 | 3,496.37 | 4,466.17 | 5,716.12 |

| Software | 688.98 | 871.84 | 1,106.62 | 1,413.43 | 1,793.64 | 2,295.35 | 2,926.30 | 3,713.73 | 4,715.65 | 5,986.91 | 7,590.48 |

| Home Energy Management (HEM) | 509.69 | 648.18 | 819.03 | 1,028.92 | 1,307.25 | 1,641.79 | 2,082.00 | 2,628.79 | 3,321.98 | 4,189.83 | 5,284.67 |

| Subsegment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Battery Electric Vehicles (BEVs) | 1,547.49 | 1,965.66 | 2,495.26 | 3,168.85 | 4,024.58 | 5,115.17 | 6,497.29 | 8,261.79 | 10,505.63 | 13,344.22 | 16,948.77 |

| Fuel Cell Vehicles (FCVs) | 144.16 | 183.12 | 232.17 | 293.71 | 372.05 | 466.64 | 591.28 | 741.09 | 925.41 | 1,171.33 | 1,475.68 |

| Plug-in Hybrid Electric Vehicles (PHEVs) | 100.35 | 125.98 | 160.15 | 202.95 | 256.36 | 324.69 | 409.15 | 514.73 | 650.60 | 820.89 | 1,043.62 |

To get full access to our Market Insights, you need a Professional Account or a Business Suite.

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Our customers work more efficiently and benefit from