Last Updated: 21 Jul 2025

Source: Statifacts

By clicking “Accept All Cookies” you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

Privacy PolicyEnergy Storage Systems Market (By Application: Battery Management Systems, Energy Storage Systems; By Region: North America, Europe, Asia Pacific, Latin America, Middle East and Africa) Industry Size, Share, Growth, Trends 2025 to 2034.

The global energy storage systems market size was evaluated at USD 485.25 million in 2024 and is expected to grow around USD 1,835.95 million by 2034, registering a CAGR of 14.23% from 2025 to 2034. Key growth factors include skyrocketing renewable energy deployment, a surge in electric vehicle (EV) adoption, government incentives aimed at decarbonization, and accelerating technological advancements, especially in lithium-ion, flow, and pumped hydro storage systems. Asia Pacific dominates this sector, while Europe stands out as the fastest-growing region thanks to progressive energy policies.

| Industry Worth | Details |

| Market Size in 2025 | USD 553.52 Million |

| Market Size by 2034 | USD 1,835.95 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.23% |

The energy storage market plays a pivotal role in modernizing energy infrastructure, assuring efficient power management across diverse sectors such as utilities, industrial, residential, commercial, and transportation. Energy storage systems, including lithium-ion batteries, flow batteries, and pumped hydro storage, are increasingly deployed to support renewable energy integration, improve grid stability, manage peak demand, and enable the rise of electric vehicles. Battery management systems (BMS) assure safe and optimized battery operation, vital in EVs, telecom base station strategies across Asia Pacific, Europe, and North America.

Artificial Intelligence is revolutionizing the energy storage systems market by improving efficiency, reliability, and sustainability. In Battery Energy Storage Systems, AI-driven predictive maintenance models analyse performance and environmental data to forecast component degradation and schedule timely interventions, prolonging battery life and minimizing downtime. AI also optimizes charging and discharging cycles using real-time electricity prices, weather forecasts, and demand signals, maximizing system utilization and revenue. Moreover, intelligent energy management systems leverage machine learning to forecast grid demand, balance loads, and participate in demand-response programs, thereby improving grid stability and reducing operational costs. These capabilities make AI a critical enable for scalable, cost-effective, and resilient energy storage, accelerating the transition to renewable-powered energy systems.

The rapid deployment of intermittent renewable energy, such as solar and wind, is increasing the need for robust energy storage systems to balance supply and demand, driving growth in the energy storage systems industry. AI-powered energy management and BMS optimize charging/discharging cycles based on real-time weather and tariff forecasts, improving grid reliability. Grid-scale storage installations, like pumped hydro and battery arrays, are pivotal in smoothing renewable generation fluctuations. Utilities and governments are incentivizing storage as part of broader grid modernization plans. This synergy boosts the adoption of energy storage systems (ESS), enabling seamless integration of renewables across markets worldwide.

Artificial intelligence has emerged as a game changer in ESS operations by supporting predictive maintenance and anomaly detection in real time. Advanced machine learning models analyse sensors with inverter data to anticipate faults, reduce downtime, and optimize asset health. AI-driven dispatch algorithms maximize storage utilization, automatically bidding into energy markets based on pricing signals. Demand response programs leverage these systems to dynamically adjust energy flows, improving system resilience. As utilities adopt AI-integrated storage solutions, operational efficiency and ROI soar, reinforcing market growth.

The growth of the energy storage systems market is restrained by factors such as High capital costs, material supply constraints, and fragmented grid integration rules are key barriers slowing the scalability and adoption of energy storage systems despite rising demand.

Despite growing demand, he energy storage industry struggles with steep upfront costs and supply chain constraints. Establishing a gigawatt-hour scale battery production facility can cost upwards of USD 500 million. This significant capital barrier limits entry for smaller players and curtails innovation. Additionally, reliance on critical materials where over 60% of lithium processing is concentrated in China and the semiconductor shortage further hamper scalability and inflate costs. These synergistic challenges slow deployment and put pressure on ROI for new storage projects.

Integrating energy storage into legacy grids presents technical and regulatory hurdles. Many grids were not designed for bidirectional power flows, leading to voltage fluctuations as seen in Arizona’s 5% grid deviations during peak battery remain fragmented. Varying interconnection standards across U.S. states and EU countries delay projects and add compliance costs. Without unified codes and streamlined market participation rules, these barriers stymie storage adoption and hinder broader grid modernization efforts.

Key growth avenues in the energy storage systems market include smart grid integration and emerging non-lithium storage technologies are unlocking major growth opportunities for energy storage providers, driving diversification and grid-wide optimization.

The integration of BMS with evolving smart grid infrastructure creates a significant opportunity for battery system providers. As smart grids increasingly rely on digital communication and real-time analytics, BMS can seamlessly coordinate energy storage with grid demands, optimizing voltage regulation, peak load management, and renewable supply balancing.

Emerging storage technologies such as thermal energy storage, compressed air, and hydrogen-based solutions present fertile ground for industrial growth. Expanding beyond lithium-ion, the “others” segment is forecasted for double-digit growth, benefiting companies that invest in innovative storage plants are entering commercial deployment, showcasing industrial appetite for diverse, large-scale ESS solutions.

“It’s about building back better,” he said, emphasizing how Octopus Energy’s AI-powered Kraken platform enables decentralized solar and battery projects in Ukraine to optimize energy use and sell surplus power back to the grid.

“The implementation and integration of all these battery projects will allow us to supply our customers with clean firm power,” he stated about Total Energies’ six new battery storage sites in Germany.

The battery management systems segment has long established its dominance in the energy storage systems market due to well-established infrastructure, proven reliability, and cost-effective bulk storage. Battery management systems assist in the delivery of high efficient energy reserves and rapid dispatch during peak demand. Ongoing investments in modernizing aging reservoirs and expanding hydro capacities bolster this segment’s lead. While lithium-ion systems grow, the segment continues to anchor the power grid and support renewable integration globally. As the renewable energy segment penetration deepens, diverse storage solutions gain traction for medium to long-duration applications. Flow batteries and hydrogen storage offer scalable, eco-friendly alternatives for large-scale energy buffering. Their technological flexibility and merging cost competitiveness make them attractive to utilities. This diversification marks a shift from traditional storage toward modular, future-ready technologies.

By application, the energy storage segment is merging as the fastest-growing in the battery energy storage market. Driven by declining lithium-ion battery costs and rising household solar adoption, homeowners are increasingly installing solar-plus-storage setups. In regions like Asia Pacific, residential BESS saw a 33% CAGR, propelled by grid instability and supportive subsidy schemes. Advanced BMS integration improves user safety and energy control at the household level. As EV charging networks mature, residential systems may also serve as vehicle-to-home energy hubs, paving the way for gigawatt-scale distributed storage.

Asia Pacific

Asia Pacific as the dominant region in 2024, capturing a commanding share of the global stationary energy storage market. This leadership is driven by rapid urbanization, large-scale renewable energy integration, and significant government investment in clean infrastructure across China, India, Japan, and South Korea. The region’s robust manufacturing capabilities, favourable policies, and urgent demand for energy security further amplify deployment, with

Europe

In the forecast period, Europe is projected to grow the fastest in the stationary energy storage segment. Strengthened by EU renewable targets, green recovery funds, and strategic grid modernization, European nations are rapidly deploying innovative storage solutions. Expansion in hydrogen-linked storage, offshore wind synchronous systems, and distributed residential and commercial setups is accelerating growth. As volatility in power markets grows, Europe’s diversified and decarbonized energy strategy positions it for substantial storage investments and market share expansion.

A joint venture between Indonesia Battery Corp and China’s CATL will launch a lithium-ion battery factory in West Java by end-2026, with an initial 6.9 GWh capacity expandable to 40GWh for EV and solar storage applications. This $ 6 billion initiative aims to support Indonesia’s goal of producing 600,000 EVs annually by 2030.

Enel and ADR have unveiled “Pioneer,” Italy’s largest life RV battery storage system, at Rome Fiumicino Airport. The 10 MWh system, repurposing 762 EV battery packs, will power ~3,000 U.S. equivalent homes for a day, improving sustainability and airport resilience.

The global energy storage industry is moderately concentrated, with oligopolistic dominated by a few large players while also featuring numerous specialized and merging firms competing in niche technologies.

Contemporary Amperex Technology Co., Limited is a global battery giant. CATL leads in both EV and ESS markets. It provides lithium-ion and LFP battery cells and integrated battery systems. The company controls nearly 90% of global ESS capacity, developing the 9 MWh TENER Stack ultra-large ESS solutions released in May 2025.

LG Energy Solutions is one of the leading non-Chinese BMS and battery players, specializing in automotive-grade and stationary storage batteries. The company is diversifying into LFP battery lines for ESS to counteract Chinese dominance and benefit from favourable tariffs. The company focuses on high-performance battery systems, safety, large-format LFP cells, and integration for grid-scale storage and EVs.

Panasonic Corporation is a diversified electronics giant. Panasonic is a leading BMS and EV battery supplier, famed for its long-standing tie-up with Tesla. The company focuses on Next-gen solid-state batteries, improved cell balancing, longer life, and safety, plus wireless and AI-improved BMS systems.

| Regions | Shares (%) |

| North America | 40% |

| Asia Pacific | 30% |

| Europe | 20% |

| LAMEA | 10% |

| Segments | Shares (%) |

| Battery Management Systems | 55% |

| Energy Storage Systems | 45% |

Published by Shubham Desale

| Application | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Battery Management Systems | 266.89 | 304.99 | 348.47 | 398.33 | 455.07 | 520.25 | 593.70 | 676.50 | 770.25 | 877.44 | 1,124.27 |

| Energy Storage Systems | 218.36 | 249.57 | 285.12 | 325.91 | 374.31 | 429.29 | 494.48 | 571.09 | 659.33 | 759.73 | 749.52 |

| Region | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| North America | 145.58 | 166.21 | 188.36 | 212.45 | 238.97 | 268.19 | 300.45 | 335.98 | 375.06 | 417.92 | 523.86 |

| Asia Pacific | 194.10 | 221.54 | 252.46 | 287.32 | 326.12 | 368.73 | 415.58 | 467.28 | 524.37 | 587.35 | 867.16 |

| Europe | 97.05 | 110.77 | 126.23 | 144.36 | 165.02 | 188.82 | 216.40 | 248.32 | 285.42 | 328.72 | 339.11 |

| LAMEA | 48.52 | 56.04 | 66.53 | 79.35 | 99.27 | 123.80 | 155.76 | 195.57 | 244.73 | 303.17 | 143.66 |

Last Updated: 21 Jul 2025

Source: Statifacts

| Subsegment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Battery Management Systems | 266.89 | 304.99 | 348.47 | 398.33 | 455.07 | 520.25 | 593.70 | 676.50 | 770.25 | 877.44 | 1,124.27 |

| Energy Storage Systems | 218.36 | 249.57 | 285.12 | 325.91 | 374.31 | 429.29 | 494.48 | 571.09 | 659.33 | 759.73 | 749.52 |

| Subsegment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| North America | 145.58 | 166.21 | 188.36 | 212.45 | 238.97 | 268.19 | 300.45 | 335.98 | 375.06 | 417.92 | 523.86 |

| Asia Pacific | 194.10 | 221.54 | 252.46 | 287.32 | 326.12 | 368.73 | 415.58 | 467.28 | 524.37 | 587.35 | 867.16 |

| Europe | 97.05 | 110.77 | 126.23 | 144.36 | 165.02 | 188.82 | 216.40 | 248.32 | 285.42 | 328.72 | 339.11 |

| LAMEA | 48.52 | 56.04 | 66.53 | 79.35 | 99.27 | 123.80 | 155.76 | 195.57 | 244.73 | 303.17 | 143.66 |

Market expansion is powered by rapid renewable energy deployment, increasing electricity demand from AI-driven data centers, and strategic grid modernization efforts. Supportive federal and state policies further accelerate investment and adoption.

Pumped hydro currently leads in scale due to its large capacity and grid support role, while lithium-ion battery storage is the fastest-growing segment, driven by declining costs and versatility across residential, commercial, and utility applications.

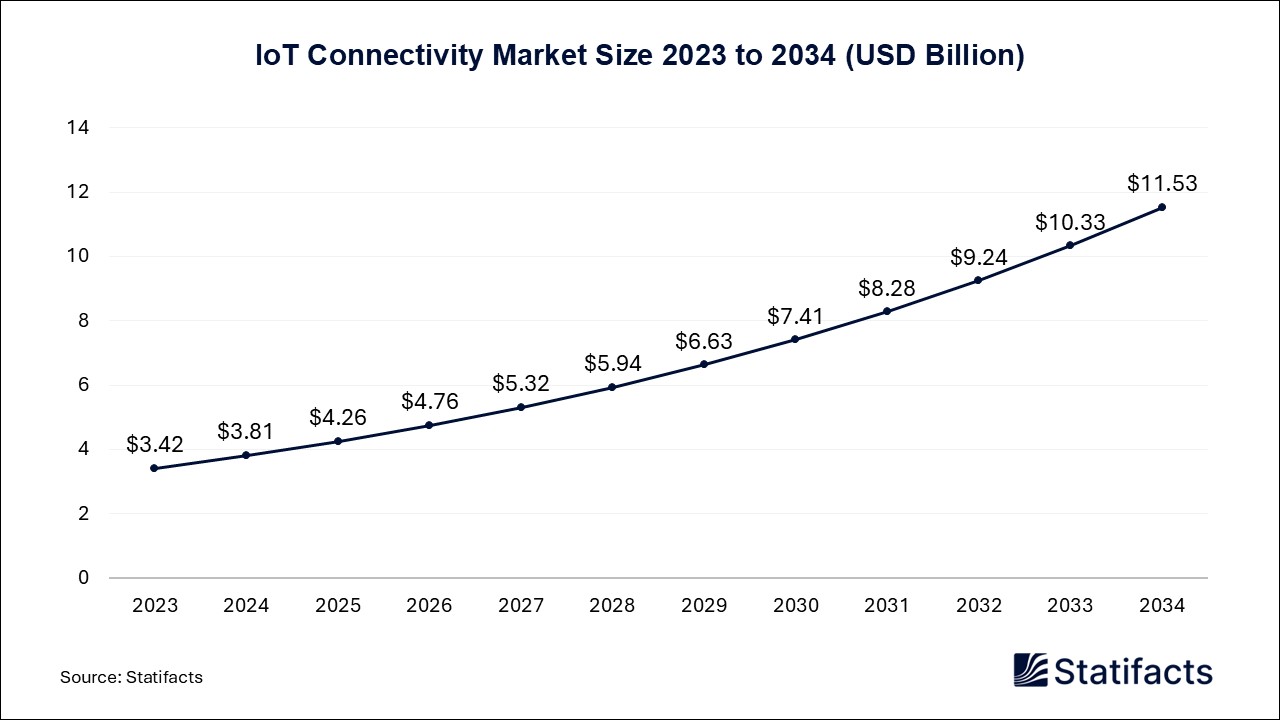

AI and IoT-powered energy management systems are enhancing storage efficiency, predictive maintenance, and real-time optimization. Meanwhile, emerging technologies like sodium-ion and solid-state batteries are gaining attention.

High upfront system and integration costs, battery lifespan concerns, lack of standardization across technologies, and complex interconnection processes impede faster deployment.

Opportunities include expanding grid-scale battery installations for renewable balancing, leveraging EV infrastructure, and capturing value from second-life or recycled batteries through partnerships like GM–Redwood.

To get full access to our Market Insights, you need a Professional Account or a Business Suite.

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Our customers work more efficiently and benefit from