By clicking “Accept All Cookies” you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

Privacy Policy

Digital Phased Array System Market (By Type: Hardware, Software & Services; By Application: Radar Systems, Satellite Communication, 5G/6G Communication, Aerospace and Defense; By Region: North America, Europe, Asia-Pacific, Latin America) Industry Size, Share, Growth, Trends 2025 to 2034.

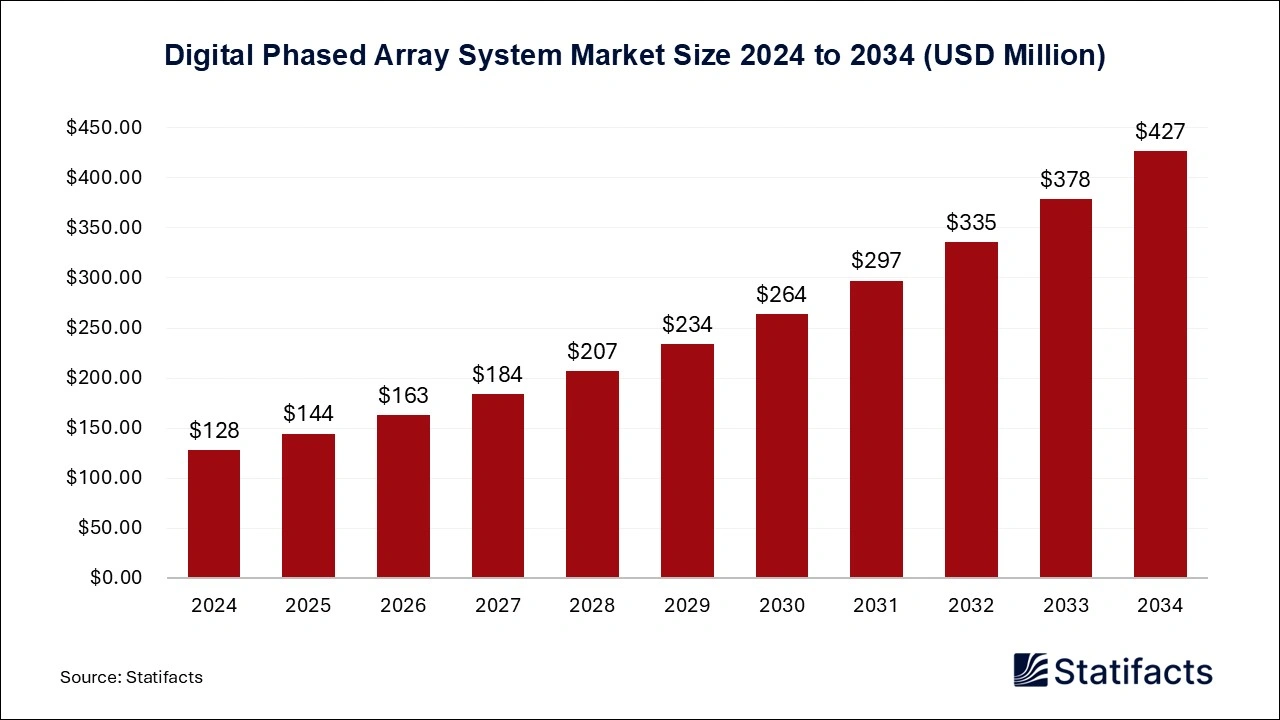

The global digital phased array system market, valued at USD 128 million in 2024, is projected to reach USD 426.88 million by 2034, growing at a CAGR of 12.8% driven by rising demand for advanced imaging, non-destructive testing, and defense applications.

Statical Scope

Statical Scope| Reports Attributes | Statistics |

| Market Size in 2024 | USD 128 Million |

| Market Size in 2025 | USD 144.38 Million |

| Market Size in 2031 | USD 297.42 Million |

| Market Size by 2034 | USD 426.88 Million |

| CAGR 2025 to 2034 | 12.8% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

The digital phased array system market is gaining traction due to the increasing focus on improving high-resolution radar and data transmission in various applications. The demand for digital phased arrays is also driven by the expansion of 5G and satellite networks. The digital systems usually require complex components with higher power, which can affect their overall costs and may hamper their adoption in some applications. The growing popularity of autonomous systems like drones, vehicles, and robotics is expected to play a crucial role in increasing their demand in the upcoming years. The growing governments in the defence sector are expected to play an opportunistic role in the growing demand for digital phased array systems.

The integration of technologies like artificial intelligence (AI) and machine learning in the digital phased array system market is expected to help in multiple ways, such as enabling real-time adjustments in signal power and beam direction to optimize performance in dynamic environments. These technologies can also enhance target detection accuracy, interference mitigation, and adaptive beamforming capabilities. Furthermore, AI-driven predictive maintenance can help in identifying potential system failures before they occur, improving reliability and operational efficiency. As machine learning models continue to evolve, they are expected to enable more autonomous decision-making within radar and communication systems, ultimately reducing human intervention and boosting overall system intelligence.

| Regions | Shares (%) |

| North America | 30% |

| Asia Pacific | 35% |

| Europe | 28% |

| Latin America | 4% |

| Middle East & Africa | 3% |

| Segments | Shares (%) |

| Hardware | 65% |

| Software & Services | 35% |

| Segments | Shares (%) |

| Radar Systems | 20% |

| Satellite Communication | 20% |

| 5G/6G Communication | 25% |

| Aerospace and Defense | 35% |

Published by Yogesh Kulkarni

| Type | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Hardware | 83.20 | 93.56 | 105.21 | 118.31 | 133.04 | 149.60 | 168.22 | 189.16 | 212.70 | 239.17 | 268.93 |

| Software & Services | 44.80 | 50.82 | 57.66 | 65.40 | 74.19 | 84.15 | 95.45 | 108.26 | 122.79 | 139.27 | 157.95 |

| Application | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Radar Systems | 25.60 | 28.59 | 31.92 | 35.64 | 39.79 | 44.41 | 49.57 | 55.32 | 61.73 | 68.88 | 76.84 |

| Satellite Communication | 25.60 | 28.59 | 31.92 | 35.64 | 39.79 | 44.41 | 49.57 | 55.32 | 61.73 | 68.88 | 76.84 |

| 5G/6G Communication | 32 | 36.53 | 41.69 | 47.58 | 54.29 | 61.94 | 70.66 | 80.60 | 91.92 | 104.83 | 119.53 |

| Aerospace and Defense | 44.80 | 50.67 | 57.34 | 64.85 | 73.36 | 82.99 | 93.87 | 106.18 | 120.11 | 135.85 | 153.67 |

| Region | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| North America | 38.40 | 43.17 | 48.53 | 54.56 | 61.34 | 68.96 | 77.52 | 87.14 | 97.96 | 110.12 | 123.79 |

| Europe | 35.84 | 40.28 | 45.28 | 50.89 | 57.19 | 64.28 | 72.25 | 81.20 | 91.25 | 102.56 | 115.26 |

| Asia-Pacific | 44.80 | 50.82 | 57.65 | 65.40 | 74.19 | 84.15 | 95.45 | 108.26 | 122.79 | 139.26 | 157.94 |

| Latin America | 5.12 | 5.78 | 6.51 | 7.35 | 8.29 | 9.35 | 10.55 | 11.90 | 13.42 | 15.14 | 17.08 |

| Middle East and Africa | 3.84 | 4.33 | 4.90 | 5.51 | 6.22 | 7.01 | 7.90 | 8.92 | 10.07 | 11.36 | 12.81 |

| Subsegment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Hardware | 83.20 | 93.56 | 105.21 | 118.31 | 133.04 | 149.60 | 168.22 | 189.16 | 212.70 | 239.17 | 268.93 |

| Software & Services | 44.80 | 50.82 | 57.66 | 65.40 | 74.19 | 84.15 | 95.45 | 108.26 | 122.79 | 139.27 | 157.95 |

| Subsegment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Radar Systems | 25.60 | 28.59 | 31.92 | 35.64 | 39.79 | 44.41 | 49.57 | 55.32 | 61.73 | 68.88 | 76.84 |

| Satellite Communication | 25.60 | 28.59 | 31.92 | 35.64 | 39.79 | 44.41 | 49.57 | 55.32 | 61.73 | 68.88 | 76.84 |

| 5G/6G Communication | 32 | 36.53 | 41.69 | 47.58 | 54.29 | 61.94 | 70.66 | 80.60 | 91.92 | 104.83 | 119.53 |

| Aerospace and Defense | 44.80 | 50.67 | 57.34 | 64.85 | 73.36 | 82.99 | 93.87 | 106.18 | 120.11 | 135.85 | 153.67 |

| Subsegment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| North America | 38.40 | 43.17 | 48.53 | 54.56 | 61.34 | 68.96 | 77.52 | 87.14 | 97.96 | 110.12 | 123.79 |

| Europe | 35.84 | 40.28 | 45.28 | 50.89 | 57.19 | 64.28 | 72.25 | 81.20 | 91.25 | 102.56 | 115.26 |

| Asia-Pacific | 44.80 | 50.82 | 57.65 | 65.40 | 74.19 | 84.15 | 95.45 | 108.26 | 122.79 | 139.26 | 157.94 |

| Latin America | 5.12 | 5.78 | 6.51 | 7.35 | 8.29 | 9.35 | 10.55 | 11.90 | 13.42 | 15.14 | 17.08 |

| Middle East and Africa | 3.84 | 4.33 | 4.90 | 5.51 | 6.22 | 7.01 | 7.90 | 8.92 | 10.07 | 11.36 | 12.81 |

To get full access to our Market Insights, you need a Professional Account or a Business Suite.

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Our customers work more efficiently and benefit from