By clicking “Accept All Cookies” you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

Privacy PolicyCoaxial Delay Lines Market (By Type: Nanosecond Delay Line, Microsecond Delay Line; By Application: Aerospace and Defense, Industrial Automation, Test and Measurement Instruments, Other; By Region: North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) Industry Size, Share, Growth, Trends 2025 to 2034.

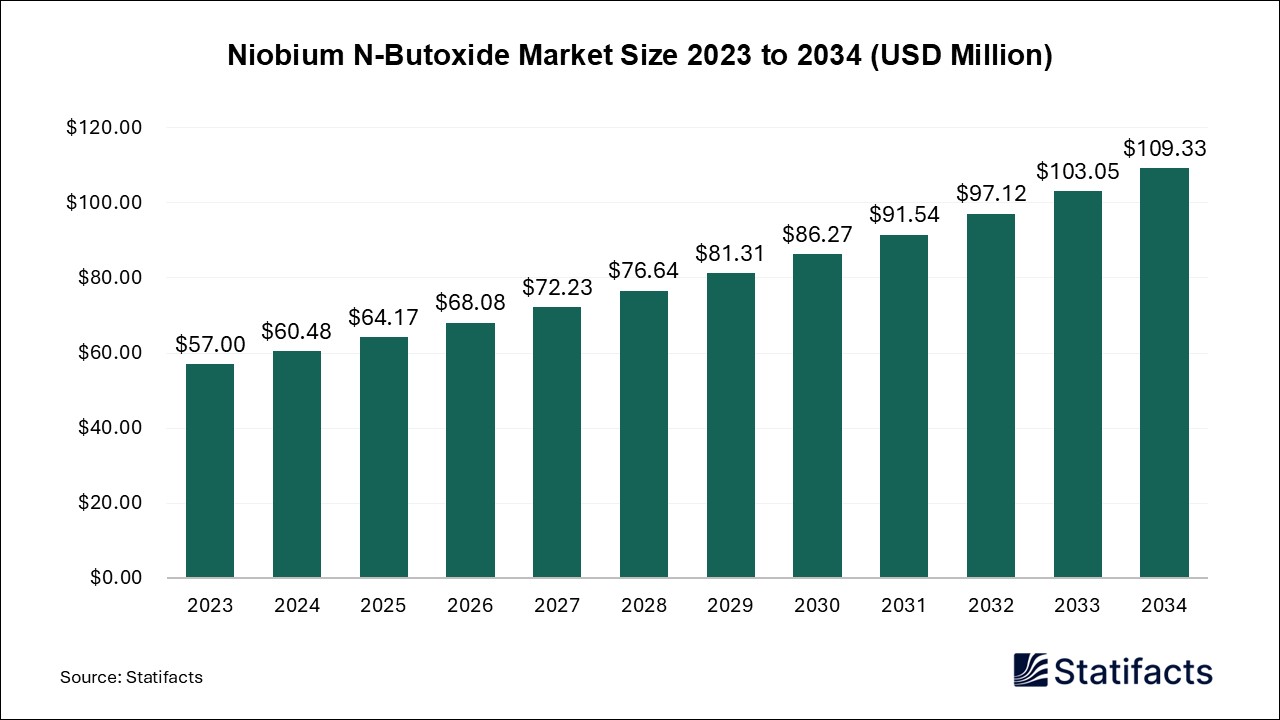

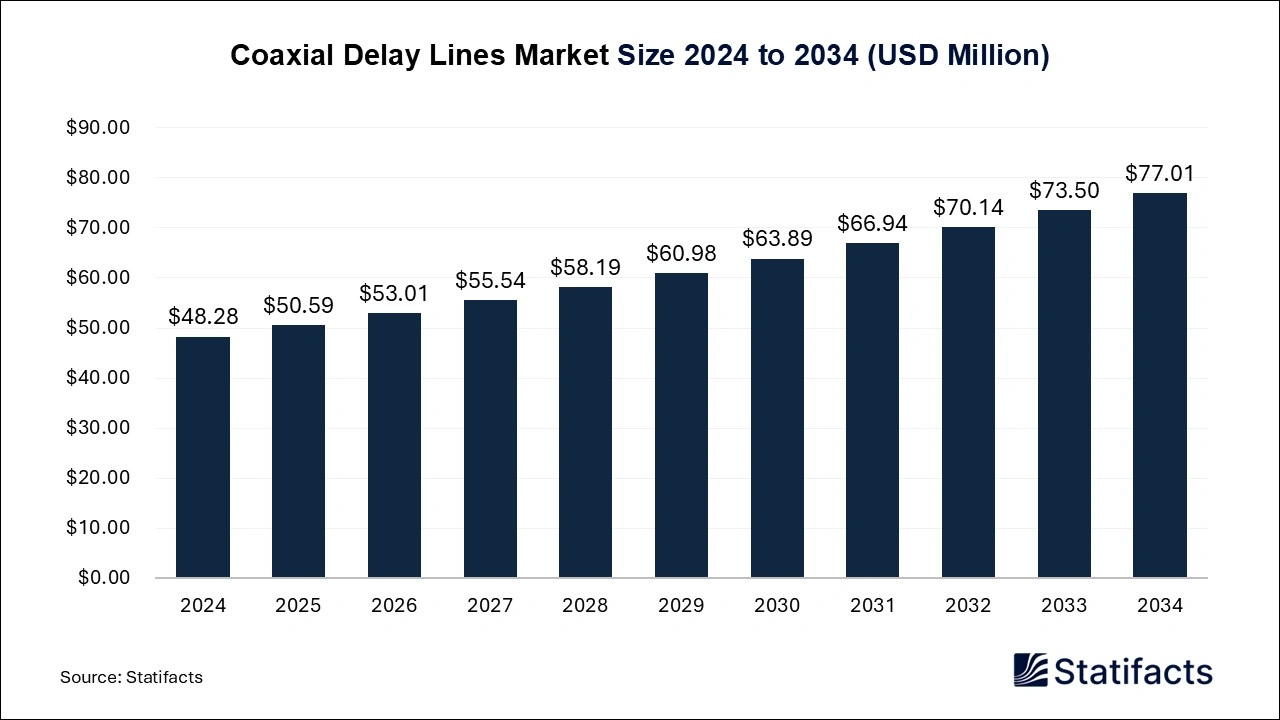

The global coaxial delay lines market, valued at USD 48.28 million in 2024, is projected to reach USD 77.01 million by 2034, growing at a CAGR of 4.78% fueled by rising demand for high-frequency signal processing in telecommunications and radar systems.

| Reports Attributes | Statistics |

| Market Size in 2024 | USD 48.28 Million |

| Market Size in 2025 | USD 50.59 Million |

| Market Size in 2031 | USD 66.94 Million |

| Market Size by 2034 | USD 77.01 Million |

| CAGR 2025 to 2034 | 4.78% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

A coaxial delay line is a passive electronic device or transmission line meant to add a precisely regulated time delay to high-frequency electrical signals. Its coaxial design, featuring a central conductor, a dielectric insulator, and an external conductive shield, ensures a stable impedance (usually 50 Ω or 75 Ω) while reducing signal loss, reflections, and electromagnetic interference. The market for coaxial delay lines is propelled by various growth factors, such as the rising need for high-speed data transmission in telecommunications and the deployment of 5G networks, which necessitate accurate signal timing for peak performance. Quick growth in industries such as defense, aerospace, and medical diagnostics boosts market expansion, as these fields rely on dependable, high-frequency coaxial solutions. Opportunities exist in meeting the growing demand for compact and high-performance parts, particularly for niche, low-volume production in developing areas such as precision medicine and cutting-edge robotics. The market encounters difficulties due to elevated production expenses, intricate manufacturing methods, and fierce competition from alternative, higher-bandwidth technologies such as fiber optics, which provide reduced costs and enhanced performance.

Artificial Intelligence (AI) is poised to revolutionize manufacturing by improving efficiency and accuracy via AI-based quality control systems capable of identifying micro-defects. AI facilitates predictive maintenance, minimizes downtime, and enhances supply chain logistics with real-time demand forecasting. AI-powered design tools can help streamline complex processes, reducing development time and costs for custom components, thereby enabling manufacturers to better meet the specific, high-specification needs of diverse industries.

| Regions | Shares (%) |

| North America | 28% |

| Asia Pacific | 38% |

| Europe | 26% |

| Latin America | 4% |

| Middle East & Africa | 4% |

| Segments | Shares (%) |

| Nanosecond Delay Line | 60% |

| Microsecond Delay Line | 40% |

| Segments | Shares (%) |

| Aerospace and Defense | 38% |

| Industrial Automation | 22% |

| Test and Measurement Instruments | 30% |

| Other | 10% |

Published by Shubham Desale

| Type | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Nanosecond Delay Line | 28.97 | 30.45 | 32.02 | 33.66 | 35.38 | 37.20 | 39.10 | 41.10 | 43.21 | 45.42 | 47.75 |

| Microsecond Delay Line | 19.31 | 20.14 | 20.99 | 21.88 | 22.81 | 23.78 | 24.79 | 25.84 | 26.93 | 28.08 | 29.26 |

| Application | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Aerospace and Defense | 18.35 | 19.17 | 20.04 | 20.94 | 21.88 | 22.87 | 23.90 | 24.97 | 26.09 | 27.27 | 28.49 |

| Industrial Automation | 10.62 | 11.18 | 11.77 | 12.39 | 13.04 | 13.72 | 14.44 | 15.20 | 15.99 | 16.83 | 17.71 |

| Test and Measurement Instruments | 14.48 | 15.18 | 15.90 | 16.66 | 17.46 | 18.29 | 19.17 | 20.08 | 21.04 | 22.05 | 23.10 |

| Other | 4.83 | 5.06 | 5.30 | 5.55 | 5.81 | 6.10 | 6.38 | 6.69 | 7.02 | 7.35 | 7.71 |

| Region | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| North America | 13.52 | 14.11 | 14.74 | 15.38 | 16.06 | 16.77 | 17.51 | 18.28 | 19.08 | 19.92 | 20.79 |

| Europe | 12.55 | 13.10 | 13.68 | 14.27 | 14.90 | 15.55 | 16.23 | 16.94 | 17.68 | 18.45 | 19.25 |

| Asia-Pacific | 18.35 | 19.32 | 20.35 | 21.44 | 22.58 | 23.78 | 25.05 | 26.38 | 27.78 | 29.25 | 30.80 |

| Latin America | 1.93 | 2.02 | 2.12 | 2.22 | 2.33 | 2.44 | 2.56 | 2.68 | 2.81 | 2.94 | 3.08 |

| Middle East and Africa | 1.93 | 2.04 | 2.12 | 2.23 | 2.32 | 2.44 | 2.54 | 2.66 | 2.79 | 2.94 | 3.09 |

| Subsegment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Nanosecond Delay Line | 28.97 | 30.45 | 32.02 | 33.66 | 35.38 | 37.20 | 39.10 | 41.10 | 43.21 | 45.42 | 47.75 |

| Microsecond Delay Line | 19.31 | 20.14 | 20.99 | 21.88 | 22.81 | 23.78 | 24.79 | 25.84 | 26.93 | 28.08 | 29.26 |

| Subsegment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Aerospace and Defense | 18.35 | 19.17 | 20.04 | 20.94 | 21.88 | 22.87 | 23.90 | 24.97 | 26.09 | 27.27 | 28.49 |

| Industrial Automation | 10.62 | 11.18 | 11.77 | 12.39 | 13.04 | 13.72 | 14.44 | 15.20 | 15.99 | 16.83 | 17.71 |

| Test and Measurement Instruments | 14.48 | 15.18 | 15.90 | 16.66 | 17.46 | 18.29 | 19.17 | 20.08 | 21.04 | 22.05 | 23.10 |

| Other | 4.83 | 5.06 | 5.30 | 5.55 | 5.81 | 6.10 | 6.38 | 6.69 | 7.02 | 7.35 | 7.71 |

| Subsegment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| North America | 13.52 | 14.11 | 14.74 | 15.38 | 16.06 | 16.77 | 17.51 | 18.28 | 19.08 | 19.92 | 20.79 |

| Europe | 12.55 | 13.10 | 13.68 | 14.27 | 14.90 | 15.55 | 16.23 | 16.94 | 17.68 | 18.45 | 19.25 |

| Asia-Pacific | 18.35 | 19.32 | 20.35 | 21.44 | 22.58 | 23.78 | 25.05 | 26.38 | 27.78 | 29.25 | 30.80 |

| Latin America | 1.93 | 2.02 | 2.12 | 2.22 | 2.33 | 2.44 | 2.56 | 2.68 | 2.81 | 2.94 | 3.08 |

| Middle East and Africa | 1.93 | 2.04 | 2.12 | 2.23 | 2.32 | 2.44 | 2.54 | 2.66 | 2.79 | 2.94 | 3.09 |

To get full access to our Market Insights, you need a Professional Account or a Business Suite.

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Our customers work more efficiently and benefit from