By clicking “Accept All Cookies” you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

Privacy PolicyAutomotive Air Conditionings Market (By Type: Standalone and Non-Standalone; By Application: Passenger Car and Commercial Vehicle; By Region: North America, Europe, Asia Pacific, and LAMEA) Industry Size, Share, Growth, Trends 2025 to 2034

The global automotive air conditioning market size was valued at USD 13.43 billion in 2024, is projected to reach approximately USD 16.86 billion by 2034. Driven by the growing number of vehicle owners and the increasing demand for in-cabin comfort. With automotive production expanding globally, particularly in emerging economies, air conditioning systems have evolved from being a luxury feature to a standard component in both passenger and commercial vehicles. Consumers are increasingly seeking vehicles that offer comfort, temperature control, and cleaner air circulation, which is fueling the demand for advanced and energy-efficient HVAC (heating, ventilation, and air conditioning) systems.

| Reports Attributes | Statistics |

| Market Size in 2024 | USD 13.43 Billion |

| Market Size in 2025 | USD 13.74 Billion |

| Market Size in 2031 | USD 15.75 Billion |

| Market Size by 2034 | USD 16.86 Billion |

| CAGR 2025 to 2034 | 2.3% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

The market is gaining momentum as countries such as China, India, and the United States continue to dominate global vehicle sales. The rapid growth in vehicle ownership and production across these countries has directly contributed to the heightened demand for automotive air conditioning systems. Additionally, rising temperatures due to climate change and the growing consumer awareness of air quality inside vehicles are further accelerating the market’s expansion. Manufacturers are focusing on designing compact, lightweight, and eco-friendly systems that consume less power and utilize environmentally responsible refrigerants to comply with global emission standards.

One of the primary factors driving the growth of the automotive air conditioning market is the increasing number of personal and commercial vehicles on the road. As disposable incomes rise and vehicle affordability improves, the number of first-time buyers is increasing, particularly in Asia-Pacific and Latin America. Moreover, the expansion of ride-sharing fleets and logistics networks is contributing to sustained demand for efficient cooling systems.

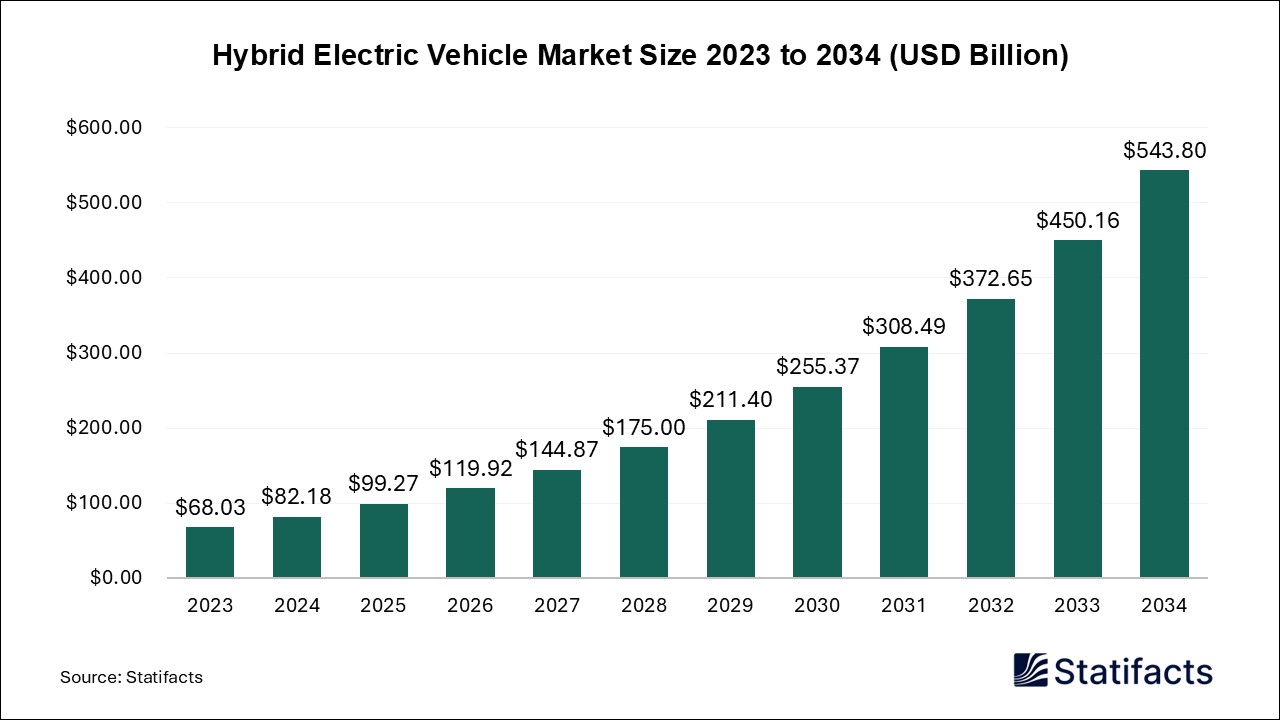

Technological advancements in vehicle HVAC systems, such as automatic climate control and dual-zone air conditioning, are also enhancing user experience. Consumers now expect seamless temperature regulation, quiet operation, and improved air purification within vehicle cabins. The introduction of electric and hybrid vehicles is further reshaping the market, as manufacturers integrate air conditioning systems that minimize energy loss and extend battery life. These factors are collectively driving innovation and performance improvements in the sector.

Although the market continues to grow steadily, certain challenges remain. High maintenance and repair costs associated with automotive air conditioning systems can discourage adoption in cost-sensitive markets. Additionally, the use of older refrigerants with high global warming potential has led to stricter regulations, compelling manufacturers to invest in research and development for alternative cooling solutions.

However, these challenges present new opportunities for innovation. The development of eco-friendly refrigerants and the growing focus on sustainable automotive design are paving the way for long-term growth. Automotive companies are also exploring the use of thermoelectric cooling systems and low-pressure compressors to enhance energy efficiency. As a result, the market is expected to benefit from increased adoption of green technologies and supportive government policies promoting low-emission vehicles.

The automotive air conditioning market is expected to witness significant transformation through the integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies. These innovations are being implemented to optimize energy usage in modern vehicles, ensuring efficient temperature control while minimizing power consumption. AI algorithms can analyze environmental conditions and automatically adjust cooling intensity, thereby improving comfort and extending vehicle performance, particularly in electric cars.

Machine learning is also being widely used for predictive maintenance, detecting irregularities in the performance of HVAC components such as compressors and filters before major failures occur. By identifying system inefficiencies in real time, manufacturers and service providers can reduce maintenance costs and enhance reliability. Furthermore, AI-driven air purification systems are being developed to monitor cabin air quality and automatically remove pollutants, offering passengers a healthier and safer driving experience.

| Regions | Shares (%) |

| North America | 30% |

| Asia Pacific | 40% |

| Europe | 25% |

| LAMEA | 5% |

| Segments | Shares (%) |

| Standalone | 60% |

| Non-Standalone | 40% |

| Segments | Shares (%) |

| Passenger Car | 70% |

| Commercial Vehicle | 30% |

Published by Ajit Bansod

| Type | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Standalone | 8.06 | 8.22 | 8.38 | 8.54 | 8.71 | 8.88 | 9.05 | 9.23 | 9.41 | 9.59 | 9.78 |

| Non-Standalone | 5.37 | 5.52 | 5.68 | 5.84 | 6 | 6.17 | 6.34 | 6.52 | 6.70 | 6.89 | 7.08 |

| Application | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Passenger Car | 9.40 | 9.59 | 9.78 | 9.98 | 10.18 | 10.38 | 10.59 | 10.80 | 11.02 | 11.24 | 11.46 |

| Commercial Vehicle | 4.03 | 4.15 | 4.27 | 4.40 | 4.53 | 4.66 | 4.80 | 4.94 | 5.09 | 5.24 | 5.39 |

| Region | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| North America | 4.03 | 4.09 | 4.16 | 4.23 | 4.29 | 4.36 | 4.43 | 4.50 | 4.58 | 4.65 | 4.72 |

| Europe | 3.36 | 3.42 | 3.49 | 3.55 | 3.62 | 3.69 | 3.76 | 3.83 | 3.90 | 3.97 | 4.05 |

| Asia Pacific | 5.37 | 5.52 | 5.68 | 5.84 | 6 | 6.17 | 6.34 | 6.52 | 6.70 | 6.89 | 7.08 |

| LAMEA | 0.67 | 0.70 | 0.73 | 0.76 | 0.79 | 0.83 | 0.86 | 0.90 | 0.93 | 0.97 | 1.01 |

| Subsegment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Standalone | 8.06 | 8.22 | 8.38 | 8.54 | 8.71 | 8.88 | 9.05 | 9.23 | 9.41 | 9.59 | 9.78 |

| Non-Standalone | 5.37 | 5.52 | 5.68 | 5.84 | 6 | 6.17 | 6.34 | 6.52 | 6.70 | 6.89 | 7.08 |

| Subsegment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Passenger Car | 9.40 | 9.59 | 9.78 | 9.98 | 10.18 | 10.38 | 10.59 | 10.80 | 11.02 | 11.24 | 11.46 |

| Commercial Vehicle | 4.03 | 4.15 | 4.27 | 4.40 | 4.53 | 4.66 | 4.80 | 4.94 | 5.09 | 5.24 | 5.39 |

| Subsegment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| North America | 4.03 | 4.09 | 4.16 | 4.23 | 4.29 | 4.36 | 4.43 | 4.50 | 4.58 | 4.65 | 4.72 |

| Europe | 3.36 | 3.42 | 3.49 | 3.55 | 3.62 | 3.69 | 3.76 | 3.83 | 3.90 | 3.97 | 4.05 |

| Asia Pacific | 5.37 | 5.52 | 5.68 | 5.84 | 6 | 6.17 | 6.34 | 6.52 | 6.70 | 6.89 | 7.08 |

| LAMEA | 0.67 | 0.70 | 0.73 | 0.76 | 0.79 | 0.83 | 0.86 | 0.90 | 0.93 | 0.97 | 1.01 |

To get full access to our Market Insights, you need a Professional Account or a Business Suite.

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Our customers work more efficiently and benefit from